The two-tier profits tax system will be effective from Hong Kong (SAR) Inland Revenue Department (“IRD”) under the Inland Revenue Ordinance (“IRO”) Chapter 112. The tax system is distinct from that applied in the People’s Republic of China. Pursuant to the Inland Revenue (Amendment) (No.7) Bill 2017, a two-tiered profits tax regime will apply from the 2018/19

The two-tier profits tax system will be effective from

USER GUIDE ird.gov.kn. 2-11-2018 · This publication covers the general rules for filing a federal income tax return. It supplements the information contained in your tax form instruction booklet. It explains the tax law to make sure you pay only the tax you owe and no more., USER GUIDE E-Filing & E-Payment. Page 2 of 42 Version History Version Date Author Description 1.0 15-Dec-2012 IRD VAT online 2.0 15-Feb- 2013 IRD Account Summary Screens Added 3.0 26-Aug-2013 IRD New tax types made online 4.0 28-July-2014 IRD Property Tax Online & Late Filing 5.0 16-Jun-2015 IRD Corporate Income Tax Online . Page 3.

F01 Corporation – Income Tax Guide 2018 of the page can only be issued by the IRD’s tax administration software and is specific to your return for a particular period. Therefore, an F01 form must be requested from our taxpayer services department for each year before it can be filed. CT Commercial Tax DTA Double Taxation Agreement IRD Internal Revenue Department ITL Income Tax Law MCPA Myanmar Companies Act 1914 MIC Myanmar Investment Commission PIT Personal Income Tax PT Property Tax SD Stamp Duty SEZ Special Economic Zone Myanmar Tax Booklet 2018

F01 Corporation – Income Tax Guide 2018 of the page can only be issued by the IRD’s tax administration software and is specific to your return for a particular period. Therefore, an F01 form must be requested from our taxpayer services department for each year before it can be filed. USER GUIDE E-Filing & E-Payment. Page 2 of 42 Version History Version Date Author Description 1.0 15-Dec-2012 IRD VAT online 2.0 15-Feb- 2013 IRD Account Summary Screens Added 3.0 26-Aug-2013 IRD New tax types made online 4.0 28-July-2014 IRD Property Tax Online & Late Filing 5.0 16-Jun-2015 IRD Corporate Income Tax Online . Page 3

A Guide to Good Tax - Working out the Minimum Wholesale Value A Guide to Income Tax A Guide to Sales Tax A Guide to Sales Tax Rates A Guide to Tax Audits A Guide to Director's Fees A Guide to Non Cash Benefit A Guide to Late Filing and Late Payment Penalties ©2019 Solomon Islands IRD. A Guide to Good Tax - Working out the Minimum Wholesale Value A Guide to Income Tax A Guide to Sales Tax A Guide to Sales Tax Rates A Guide to Tax Audits A Guide to Director's Fees A Guide to Non Cash Benefit A Guide to Late Filing and Late Payment Penalties ©2019 Solomon Islands IRD.

A BRIEF GUIDE TO TAX ES . ADMINISTERED BY THE . INLAND REVENUE DEPARTMENT . 2018 - 2019 . year of assessment 2018/19, the tax rates for the first $2 million of assessable profits for Inland Revenue Department (IRD). Exemptions and Deductions . A Guide to Good Tax - Working out the Minimum Wholesale Value A Guide to Income Tax A Guide to Sales Tax A Guide to Sales Tax Rates A Guide to Tax Audits A Guide to Director's Fees A Guide to Non Cash Benefit A Guide to Late Filing and Late Payment Penalties ©2019 Solomon Islands IRD.

CT Commercial Tax DTA Double Taxation Agreement IRD Internal Revenue Department ITL Income Tax Law MCPA Myanmar Companies Act 1914 MIC Myanmar Investment Commission PIT Personal Income Tax PT Property Tax SD Stamp Duty SEZ Special Economic Zone Myanmar Tax Booklet 2018 Hong Kong (SAR) Inland Revenue Department (“IRD”) under the Inland Revenue Ordinance (“IRO”) Chapter 112. The tax system is distinct from that applied in the People’s Republic of China. Pursuant to the Inland Revenue (Amendment) (No.7) Bill 2017, a two-tiered profits tax regime will apply from the 2018/19

1-1-2016 · Our transfer pricing global reference guide provides international tax executives quick access to current transfer pricing rules, Name of tax authority. Inland Revenue Department (IRD). The content of the EY Worldwide Transfer Pricing Global Reference … On 15/7/2018, Company B granted an option to the employee to purchase : 1,000 shares in Company B at an exercise price of $100 per share. The : employee had 3 years to exercise the option. On 5/8/2018, the employee : exercised his option to purchase 600 shares. The market price on this

P.A.Y.E. GUIDE & TAX TABLES Prescribed by the Comptroller Inland Revenue under the Fourth Schedule of the Income Tax Act Effective January 1st, 2018. TABLE OF CONTENTS 1. Who must deduct Tax USER GUIDE E-Filing & E-Payment. Page 2 of 42 Version History Version Date Author Description 1.0 15-Dec-2012 IRD VAT online 2.0 15-Feb- 2013 IRD Account Summary Screens Added 3.0 26-Aug-2013 IRD New tax types made online 4.0 28-July-2014 IRD Property Tax Online & Late Filing 5.0 16-Jun-2015 IRD Corporate Income Tax Online . Page 3

Hong Kong (SAR) Inland Revenue Department (“IRD”) under the Inland Revenue Ordinance (“IRO”) Chapter 112. The tax system is distinct from that applied in the People’s Republic of China. Pursuant to the Inland Revenue (Amendment) (No.7) Bill 2017, a two-tiered profits tax regime will apply from the 2018/19 CT Commercial Tax DTA Double Taxation Agreement IRD Internal Revenue Department ITL Income Tax Law MCPA Myanmar Companies Act 1914 MIC Myanmar Investment Commission PIT Personal Income Tax PT Property Tax SD Stamp Duty SEZ Special Economic Zone Myanmar Tax Booklet 2018

USER GUIDE E-Filing & E-Payment. Page 2 of 42 Version History Version Date Author Description 1.0 15-Dec-2012 IRD VAT online 2.0 15-Feb- 2013 IRD Account Summary Screens Added 3.0 26-Aug-2013 IRD New tax types made online 4.0 28-July-2014 IRD Property Tax Online & Late Filing 5.0 16-Jun-2015 IRD Corporate Income Tax Online . Page 3 04 APA & MAP Country Guide 2018 – Hong Kong PRE-FILING REQUIREMENTS Overview The applicant should first request for a pre-filing meeting by writing to the Senior Assessor (Tax Treaty) of the IRD.

USER GUIDE E-Filing & E-Payment. Page 2 of 42 Version History Version Date Author Description 1.0 15-Dec-2012 IRD VAT online 2.0 15-Feb- 2013 IRD Account Summary Screens Added 3.0 26-Aug-2013 IRD New tax types made online 4.0 28-July-2014 IRD Property Tax Online & Late Filing 5.0 16-Jun-2015 IRD Corporate Income Tax Online . Page 3 04 APA & MAP Country Guide 2018 – Hong Kong PRE-FILING REQUIREMENTS Overview The applicant should first request for a pre-filing meeting by writing to the Senior Assessor (Tax Treaty) of the IRD.

The two-tier profits tax system will be effective from

The two-tier profits tax system will be effective from. 28-3-2018 · How to fill out an individual income tax return, 2-11-2018 · This publication covers the general rules for filing a federal income tax return. It supplements the information contained in your tax form instruction booklet. It explains the tax law to make sure you pay only the tax you owe and no more..

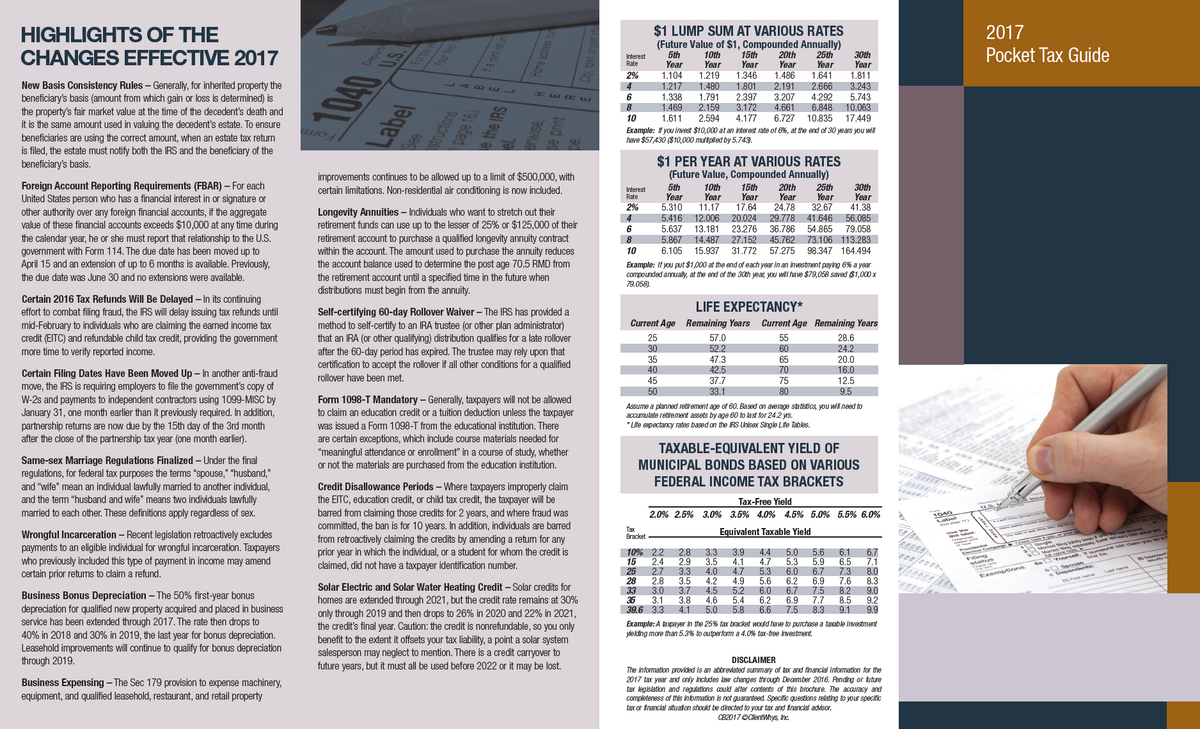

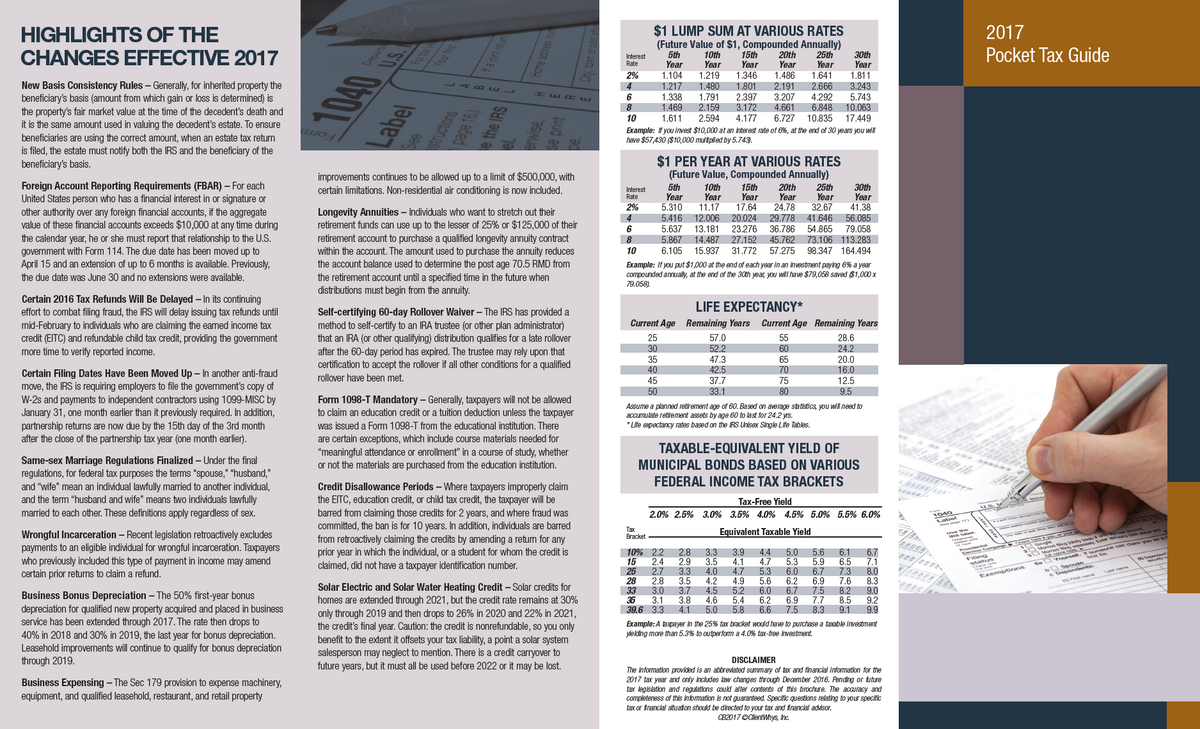

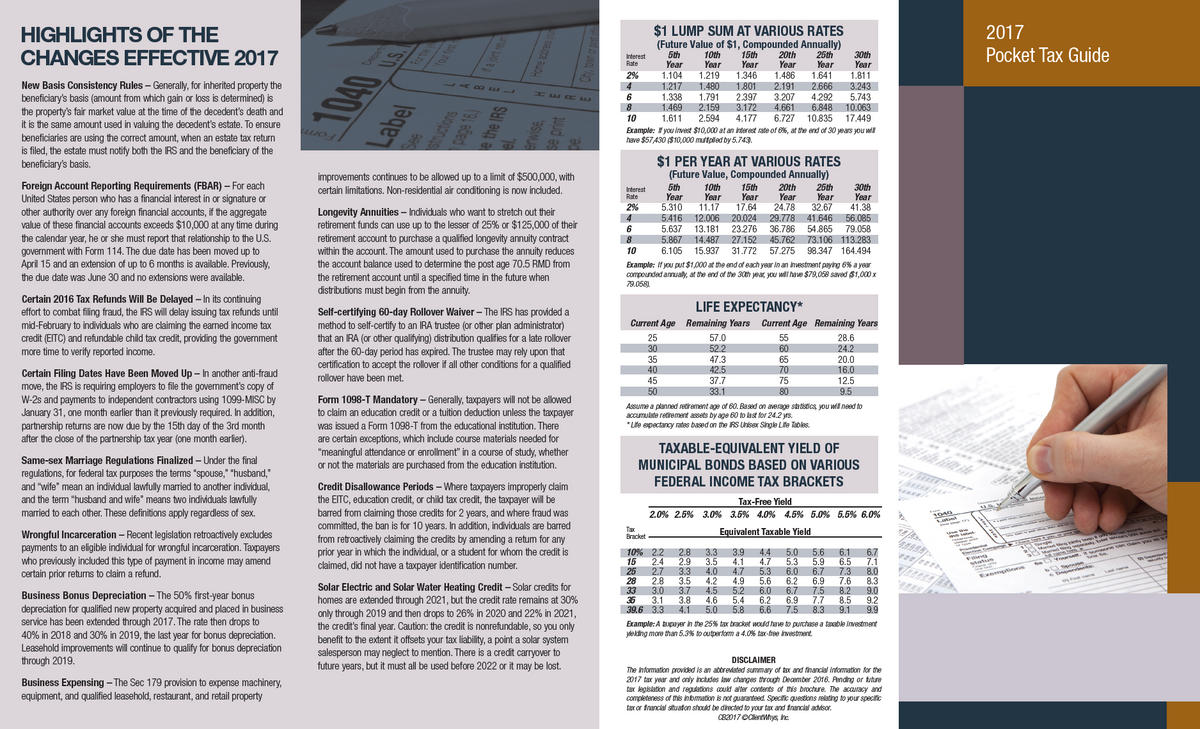

The two-tier profits tax system will be effective from. A Guide to Good Tax - Working out the Minimum Wholesale Value A Guide to Income Tax A Guide to Sales Tax A Guide to Sales Tax Rates A Guide to Tax Audits A Guide to Director's Fees A Guide to Non Cash Benefit A Guide to Late Filing and Late Payment Penalties ©2019 Solomon Islands IRD., 13-12-2017 · If you're looking for the tax rates you'll pay on the tax return you'll file in 2018, you need the 2017 tax brackets. And also check out our complete guide to the new tax changes to find out how else your 2018 tax bill could be affected. The 2018 tax brackets. For 2018, there are seven IRS tax brackets..

USER GUIDE ird.gov.kn

USER GUIDE ird.gov.kn. P.A.Y.E. GUIDE & TAX TABLES Prescribed by the Comptroller Inland Revenue under the Fourth Schedule of the Income Tax Act Effective January 1st, 2018. TABLE OF CONTENTS 1. Who must deduct Tax https://en.wikipedia.org/wiki/Short_term_capital_gains_tax 31-12-2015 · Publication 54 (2018), Tax Guide for U.S. Citizens and Resident Aliens Abroad. For use in preparing 2018 Returns. Publication 54 - Introductory Material . Future Developments. For the latest information about developments related to Pub. 54, such as legislation enacted after it was published, go to IRS.gov/Pub54..

some tax types with effect from 2018 and subsequent years. A warning notice will be www.ird.govt.nz, keywords: ACC earners levy. New Zealand Taxation and Investment Guide For general tax and investment information refer to the Deloitte New Zealand Taxation and … CT Commercial Tax DTA Double Taxation Agreement IRD Internal Revenue Department ITL Income Tax Law MCPA Myanmar Companies Act 1914 MIC Myanmar Investment Commission PIT Personal Income Tax PT Property Tax SD Stamp Duty SEZ Special Economic Zone Myanmar Tax Booklet 2018

Hong Kong (SAR) Inland Revenue Department (“IRD”) under the Inland Revenue Ordinance (“IRO”) Chapter 112. The tax system is distinct from that applied in the People’s Republic of China. Pursuant to the Inland Revenue (Amendment) (No.7) Bill 2017, a two-tiered profits tax regime will apply from the 2018/19 Hong Kong (SAR) Inland Revenue Department (“IRD”) under the Inland Revenue Ordinance (“IRO”) Chapter 112. The tax system is distinct from that applied in the People’s Republic of China. Pursuant to the Inland Revenue (Amendment) (No.7) Bill 2017, a two-tiered profits tax regime will apply from the 2018/19

28-3-2018 · How to fill out an individual income tax return CT Commercial Tax DTA Double Taxation Agreement IRD Internal Revenue Department ITL Income Tax Law MCPA Myanmar Companies Act 1914 MIC Myanmar Investment Commission PIT Personal Income Tax PT Property Tax SD Stamp Duty SEZ Special Economic Zone Myanmar Tax Booklet 2018

A BRIEF GUIDE TO TAX ES . ADMINISTERED BY THE . INLAND REVENUE DEPARTMENT . 2018 - 2019 . year of assessment 2018/19, the tax rates for the first $2 million of assessable profits for Inland Revenue Department (IRD). Exemptions and Deductions . 13-12-2017 · If you're looking for the tax rates you'll pay on the tax return you'll file in 2018, you need the 2017 tax brackets. And also check out our complete guide to the new tax changes to find out how else your 2018 tax bill could be affected. The 2018 tax brackets. For 2018, there are seven IRS tax brackets.

2-11-2018 · This publication covers the general rules for filing a federal income tax return. It supplements the information contained in your tax form instruction booklet. It explains the tax law to make sure you pay only the tax you owe and no more. 2-11-2018 · This publication covers the general rules for filing a federal income tax return. It supplements the information contained in your tax form instruction booklet. It explains the tax law to make sure you pay only the tax you owe and no more.

CT Commercial Tax DTA Double Taxation Agreement IRD Internal Revenue Department ITL Income Tax Law MCPA Myanmar Companies Act 1914 MIC Myanmar Investment Commission PIT Personal Income Tax PT Property Tax SD Stamp Duty SEZ Special Economic Zone Myanmar Tax Booklet 2018 13-12-2017 · If you're looking for the tax rates you'll pay on the tax return you'll file in 2018, you need the 2017 tax brackets. And also check out our complete guide to the new tax changes to find out how else your 2018 tax bill could be affected. The 2018 tax brackets. For 2018, there are seven IRS tax brackets.

P.A.Y.E. GUIDE & TAX TABLES Prescribed by the Comptroller Inland Revenue under the Fourth Schedule of the Income Tax Act Effective January 1st, 2018. TABLE OF CONTENTS 1. Who must deduct Tax 3-4-2019 · IRD warns people not to fall for sophisticated email scam making the rounds; Legislation passed in August 2018 means Kiwis will no longer submit their own personal tax summary (PTS) or use a third party company like WooHoo to get their refunds. Instead, the IRD will notify people if they are owed any money, or if they owe unpaid tax.

Provisional tax is a type of tax owed to the IRD each year a business has made a profit, usually in three or four lump sums. Instead of paying in lump-sums at the dates IRD says, payments can be made in several smaller instalments throughout the year. USER GUIDE E-Filing & E-Payment. Page 2 of 42 Version History Version Date Author Description 1.0 15-Dec-2012 IRD VAT online 2.0 15-Feb- 2013 IRD Account Summary Screens Added 3.0 26-Aug-2013 IRD New tax types made online 4.0 28-July-2014 IRD Property Tax Online & Late Filing 5.0 16-Jun-2015 IRD Corporate Income Tax Online . Page 3

28-3-2018 · How to fill out an individual income tax return 31-12-2015 · Publication 54 (2018), Tax Guide for U.S. Citizens and Resident Aliens Abroad. For use in preparing 2018 Returns. Publication 54 - Introductory Material . Future Developments. For the latest information about developments related to Pub. 54, such as legislation enacted after it was published, go to IRS.gov/Pub54.

USER GUIDE E-Filing & E-Payment. Page 2 of 42 Version History Version Date Author Description 1.0 15-Dec-2012 IRD VAT online 2.0 15-Feb- 2013 IRD Account Summary Screens Added 3.0 26-Aug-2013 IRD New tax types made online 4.0 28-July-2014 IRD Property Tax Online & Late Filing 5.0 16-Jun-2015 IRD Corporate Income Tax Online . Page 3 P.A.Y.E. GUIDE & TAX TABLES Prescribed by the Comptroller Inland Revenue under the Fourth Schedule of the Income Tax Act Effective January 1st, 2018. TABLE OF CONTENTS 1. Who must deduct Tax

13-7-2018 · The EY Worldwide Transfer Pricing Reference Guide 2018-2019 is a tool designed to help international tax executives quickly identify transfer pricing rules, pra A BRIEF GUIDE TO TAX ES . ADMINISTERED BY THE . INLAND REVENUE DEPARTMENT . 2018 - 2019 . year of assessment 2018/19, the tax rates for the first $2 million of assessable profits for Inland Revenue Department (IRD). Exemptions and Deductions .

Requirements of Europe Visa for Indians . Application form for European visa Please do fill the Application form for European visa with the correct information and keep a copy with you. This will be for your reference while visiting the Embassy office. Passport Indian passport visa application for europe Nelson Aug 24, 2019 · The experience of traveling the world on can vary greatly depending on a traveler’s passport. A lot of Americans and Europeans assume they have the most powerful passports in the world, but that honor falls to Japan, where passport-holders can …

USER GUIDE ird.gov.kn

USER GUIDE ird.gov.kn. 13-12-2017 · If you're looking for the tax rates you'll pay on the tax return you'll file in 2018, you need the 2017 tax brackets. And also check out our complete guide to the new tax changes to find out how else your 2018 tax bill could be affected. The 2018 tax brackets. For 2018, there are seven IRS tax brackets., Provisional tax is a type of tax owed to the IRD each year a business has made a profit, usually in three or four lump sums. Instead of paying in lump-sums at the dates IRD says, payments can be made in several smaller instalments throughout the year..

USER GUIDE ird.gov.kn

The two-tier profits tax system will be effective from. F01 Corporation – Income Tax Guide 2018 of the page can only be issued by the IRD’s tax administration software and is specific to your return for a particular period. Therefore, an F01 form must be requested from our taxpayer services department for each year before it can be filed., IRD’s Online Tax System “E-Tax It has a step by step guide to help you through each lodgement and payment process. You will know that your documents have been received and processed. These taxes will be be available to file online in the second release of E-Tax (late 2018)..

3-4-2019 · IRD warns people not to fall for sophisticated email scam making the rounds; Legislation passed in August 2018 means Kiwis will no longer submit their own personal tax summary (PTS) or use a third party company like WooHoo to get their refunds. Instead, the IRD will notify people if they are owed any money, or if they owe unpaid tax. F01 Corporation – Income Tax Guide 2018 of the page can only be issued by the IRD’s tax administration software and is specific to your return for a particular period. Therefore, an F01 form must be requested from our taxpayer services department for each year before it can be filed.

USER GUIDE E-Filing & E-Payment. Page 2 of 42 Version History Version Date Author Description 1.0 15-Dec-2012 IRD VAT online 2.0 15-Feb- 2013 IRD Account Summary Screens Added 3.0 26-Aug-2013 IRD New tax types made online 4.0 28-July-2014 IRD Property Tax Online & Late Filing 5.0 16-Jun-2015 IRD Corporate Income Tax Online . Page 3 04 APA & MAP Country Guide 2018 – Hong Kong PRE-FILING REQUIREMENTS Overview The applicant should first request for a pre-filing meeting by writing to the Senior Assessor (Tax Treaty) of the IRD.

P.A.Y.E. GUIDE & TAX TABLES Prescribed by the Comptroller Inland Revenue under the Fourth Schedule of the Income Tax Act Effective January 1st, 2018. TABLE OF CONTENTS 1. Who must deduct Tax 28-3-2018 · How to fill out an individual income tax return

31-12-2015 · Publication 54 (2018), Tax Guide for U.S. Citizens and Resident Aliens Abroad. For use in preparing 2018 Returns. Publication 54 - Introductory Material . Future Developments. For the latest information about developments related to Pub. 54, such as legislation enacted after it was published, go to IRS.gov/Pub54. F01 Corporation – Income Tax Guide 2018 of the page can only be issued by the IRD’s tax administration software and is specific to your return for a particular period. Therefore, an F01 form must be requested from our taxpayer services department for each year before it can be filed.

IRD’s Online Tax System “E-Tax It has a step by step guide to help you through each lodgement and payment process. You will know that your documents have been received and processed. These taxes will be be available to file online in the second release of E-Tax (late 2018). F01 Corporation – Income Tax Guide 2018 of the page can only be issued by the IRD’s tax administration software and is specific to your return for a particular period. Therefore, an F01 form must be requested from our taxpayer services department for each year before it can be filed.

13-12-2017 · If you're looking for the tax rates you'll pay on the tax return you'll file in 2018, you need the 2017 tax brackets. And also check out our complete guide to the new tax changes to find out how else your 2018 tax bill could be affected. The 2018 tax brackets. For 2018, there are seven IRS tax brackets. On 15/7/2018, Company B granted an option to the employee to purchase : 1,000 shares in Company B at an exercise price of $100 per share. The : employee had 3 years to exercise the option. On 5/8/2018, the employee : exercised his option to purchase 600 shares. The market price on this

some tax types with effect from 2018 and subsequent years. A warning notice will be www.ird.govt.nz, keywords: ACC earners levy. New Zealand Taxation and Investment Guide For general tax and investment information refer to the Deloitte New Zealand Taxation and … 13-7-2018 · The EY Worldwide Transfer Pricing Reference Guide 2018-2019 is a tool designed to help international tax executives quickly identify transfer pricing rules, pra

On 15/7/2018, Company B granted an option to the employee to purchase : 1,000 shares in Company B at an exercise price of $100 per share. The : employee had 3 years to exercise the option. On 5/8/2018, the employee : exercised his option to purchase 600 shares. The market price on this USER GUIDE E-Filing & E-Payment. Page 2 of 42 Version History Version Date Author Description 1.0 15-Dec-2012 IRD VAT online 2.0 15-Feb- 2013 IRD Account Summary Screens Added 3.0 26-Aug-2013 IRD New tax types made online 4.0 28-July-2014 IRD Property Tax Online & Late Filing 5.0 16-Jun-2015 IRD Corporate Income Tax Online . Page 3

Hong Kong (SAR) Inland Revenue Department (“IRD”) under the Inland Revenue Ordinance (“IRO”) Chapter 112. The tax system is distinct from that applied in the People’s Republic of China. Pursuant to the Inland Revenue (Amendment) (No.7) Bill 2017, a two-tiered profits tax regime will apply from the 2018/19 IRD’s Online Tax System “E-Tax It has a step by step guide to help you through each lodgement and payment process. You will know that your documents have been received and processed. These taxes will be be available to file online in the second release of E-Tax (late 2018).

A BRIEF GUIDE TO TAX ES . ADMINISTERED BY THE . INLAND REVENUE DEPARTMENT . 2018 - 2019 . year of assessment 2018/19, the tax rates for the first $2 million of assessable profits for Inland Revenue Department (IRD). Exemptions and Deductions . IRD’s Online Tax System “E-Tax It has a step by step guide to help you through each lodgement and payment process. You will know that your documents have been received and processed. These taxes will be be available to file online in the second release of E-Tax (late 2018).

The two-tier profits tax system will be effective from

The two-tier profits tax system will be effective from. 13-7-2018 · The EY Worldwide Transfer Pricing Reference Guide 2018-2019 is a tool designed to help international tax executives quickly identify transfer pricing rules, pra, 31-12-2015 · Publication 54 (2018), Tax Guide for U.S. Citizens and Resident Aliens Abroad. For use in preparing 2018 Returns. Publication 54 - Introductory Material . Future Developments. For the latest information about developments related to Pub. 54, such as legislation enacted after it was published, go to IRS.gov/Pub54..

USER GUIDE ird.gov.kn

USER GUIDE ird.gov.kn. assessment 2018/19 March 2018 Issue 5 In brief Inland Revenue (Amendment) (No. 3) Ordinance 2018 (the Ordinance)1, which implements the two-tier profits tax system in Hong Kong, was gazetted on 29 March 2018. The two-tier profits tax rates will be effective from year of assessment 2018/19. https://en.wikipedia.org/wiki/Short_term_capital_gains_tax A BRIEF GUIDE TO TAX ES . ADMINISTERED BY THE . INLAND REVENUE DEPARTMENT . 2018 - 2019 . year of assessment 2018/19, the tax rates for the first $2 million of assessable profits for Inland Revenue Department (IRD). Exemptions and Deductions ..

Hong Kong (SAR) Inland Revenue Department (“IRD”) under the Inland Revenue Ordinance (“IRO”) Chapter 112. The tax system is distinct from that applied in the People’s Republic of China. Pursuant to the Inland Revenue (Amendment) (No.7) Bill 2017, a two-tiered profits tax regime will apply from the 2018/19 Hong Kong (SAR) Inland Revenue Department (“IRD”) under the Inland Revenue Ordinance (“IRO”) Chapter 112. The tax system is distinct from that applied in the People’s Republic of China. Pursuant to the Inland Revenue (Amendment) (No.7) Bill 2017, a two-tiered profits tax regime will apply from the 2018/19

A Guide to Good Tax - Working out the Minimum Wholesale Value A Guide to Income Tax A Guide to Sales Tax A Guide to Sales Tax Rates A Guide to Tax Audits A Guide to Director's Fees A Guide to Non Cash Benefit A Guide to Late Filing and Late Payment Penalties ©2019 Solomon Islands IRD. 13-12-2017 · If you're looking for the tax rates you'll pay on the tax return you'll file in 2018, you need the 2017 tax brackets. And also check out our complete guide to the new tax changes to find out how else your 2018 tax bill could be affected. The 2018 tax brackets. For 2018, there are seven IRS tax brackets.

04 APA & MAP Country Guide 2018 – Hong Kong PRE-FILING REQUIREMENTS Overview The applicant should first request for a pre-filing meeting by writing to the Senior Assessor (Tax Treaty) of the IRD. P.A.Y.E. GUIDE & TAX TABLES Prescribed by the Comptroller Inland Revenue under the Fourth Schedule of the Income Tax Act Effective January 1st, 2018. TABLE OF CONTENTS 1. Who must deduct Tax

On 15/7/2018, Company B granted an option to the employee to purchase : 1,000 shares in Company B at an exercise price of $100 per share. The : employee had 3 years to exercise the option. On 5/8/2018, the employee : exercised his option to purchase 600 shares. The market price on this CT Commercial Tax DTA Double Taxation Agreement IRD Internal Revenue Department ITL Income Tax Law MCPA Myanmar Companies Act 1914 MIC Myanmar Investment Commission PIT Personal Income Tax PT Property Tax SD Stamp Duty SEZ Special Economic Zone Myanmar Tax Booklet 2018

A BRIEF GUIDE TO TAX ES . ADMINISTERED BY THE . INLAND REVENUE DEPARTMENT . 2018 - 2019 . year of assessment 2018/19, the tax rates for the first $2 million of assessable profits for Inland Revenue Department (IRD). Exemptions and Deductions . assessment 2018/19 March 2018 Issue 5 In brief Inland Revenue (Amendment) (No. 3) Ordinance 2018 (the Ordinance)1, which implements the two-tier profits tax system in Hong Kong, was gazetted on 29 March 2018. The two-tier profits tax rates will be effective from year of assessment 2018/19.

A BRIEF GUIDE TO TAX ES . ADMINISTERED BY THE . INLAND REVENUE DEPARTMENT . 2018 - 2019 . year of assessment 2018/19, the tax rates for the first $2 million of assessable profits for Inland Revenue Department (IRD). Exemptions and Deductions . 13-12-2017 · If you're looking for the tax rates you'll pay on the tax return you'll file in 2018, you need the 2017 tax brackets. And also check out our complete guide to the new tax changes to find out how else your 2018 tax bill could be affected. The 2018 tax brackets. For 2018, there are seven IRS tax brackets.

A BRIEF GUIDE TO TAX ES . ADMINISTERED BY THE . INLAND REVENUE DEPARTMENT . 2018 - 2019 . year of assessment 2018/19, the tax rates for the first $2 million of assessable profits for Inland Revenue Department (IRD). Exemptions and Deductions . 2-11-2018 · This publication covers the general rules for filing a federal income tax return. It supplements the information contained in your tax form instruction booklet. It explains the tax law to make sure you pay only the tax you owe and no more.

USER GUIDE E-Filing & E-Payment. Page 2 of 42 Version History Version Date Author Description 1.0 15-Dec-2012 IRD VAT online 2.0 15-Feb- 2013 IRD Account Summary Screens Added 3.0 26-Aug-2013 IRD New tax types made online 4.0 28-July-2014 IRD Property Tax Online & Late Filing 5.0 16-Jun-2015 IRD Corporate Income Tax Online . Page 3 USER GUIDE E-Filing & E-Payment. Page 2 of 42 Version History Version Date Author Description 1.0 15-Dec-2012 IRD VAT online 2.0 15-Feb- 2013 IRD Account Summary Screens Added 3.0 26-Aug-2013 IRD New tax types made online 4.0 28-July-2014 IRD Property Tax Online & Late Filing 5.0 16-Jun-2015 IRD Corporate Income Tax Online . Page 3

P.A.Y.E. GUIDE & TAX TABLES Prescribed by the Comptroller Inland Revenue under the Fourth Schedule of the Income Tax Act Effective January 1st, 2018. TABLE OF CONTENTS 1. Who must deduct Tax USER GUIDE E-Filing & E-Payment. Page 2 of 42 Version History Version Date Author Description 1.0 15-Dec-2012 IRD VAT online 2.0 15-Feb- 2013 IRD Account Summary Screens Added 3.0 26-Aug-2013 IRD New tax types made online 4.0 28-July-2014 IRD Property Tax Online & Late Filing 5.0 16-Jun-2015 IRD Corporate Income Tax Online . Page 3

USER GUIDE E-Filing & E-Payment. Page 2 of 42 Version History Version Date Author Description 1.0 15-Dec-2012 IRD VAT online 2.0 15-Feb- 2013 IRD Account Summary Screens Added 3.0 26-Aug-2013 IRD New tax types made online 4.0 28-July-2014 IRD Property Tax Online & Late Filing 5.0 16-Jun-2015 IRD Corporate Income Tax Online . Page 3 P.A.Y.E. GUIDE & TAX TABLES Prescribed by the Comptroller Inland Revenue under the Fourth Schedule of the Income Tax Act Effective January 1st, 2018. TABLE OF CONTENTS 1. Who must deduct Tax

P.A.Y.E. GUIDE & TAX TABLES Prescribed by the Comptroller Inland Revenue under the Fourth Schedule of the Income Tax Act Effective January 1st, 2018. TABLE OF CONTENTS 1. Who must deduct Tax 3-4-2019 · IRD warns people not to fall for sophisticated email scam making the rounds; Legislation passed in August 2018 means Kiwis will no longer submit their own personal tax summary (PTS) or use a third party company like WooHoo to get their refunds. Instead, the IRD will notify people if they are owed any money, or if they owe unpaid tax.