Property and Casualty Insurance provides coverage for damage to property and liability risks, including policies like homeowners, auto, and commercial insurance, essential for risk management and financial protection.

Overview of Property and Casualty Insurance

Property and Casualty (P&C) Insurance provides coverage for damage to property and liability risks, protecting individuals and businesses from financial losses due to unforeseen events. It encompasses various policies, including homeowners, auto, and commercial insurance, ensuring protection against direct damage and legal liabilities. This type of insurance is essential for managing risks associated with property ownership and operational activities. Understanding its fundamentals is crucial for agents and policyholders alike, as it helps in selecting appropriate coverage and mitigating potential losses effectively. The study guide offers detailed insights into these concepts, aiding in exam preparation and real-world application.

Key Concepts Covered in the Study Guide

The study guide covers property insurance types, casualty liability, homeowners, auto, and commercial policies, risk management strategies, and state-specific requirements, ensuring comprehensive preparation for the exam with practice tests and free PDF resources.

Property Insurance: Types and Coverage

Property insurance protects against losses to property, including damage or theft. Types include homeowners, commercial, and inland marine insurance. Homeowners insurance covers dwellings, personal property, and liability, while commercial property insurance safeguards businesses. Inland marine insurance protects goods in transit. Policies typically cover perils like fire, windstorms, and vandalism. Additional coverage options may include flood or earthquake insurance. Understanding these types and their coverage is crucial for effective risk management. The study guide provides detailed explanations and examples to help candidates grasp these concepts thoroughly, ensuring they are well-prepared for the exam with a strong foundation in property insurance principles.

Casualty Insurance: Liability and Risk Management

Casualty insurance focuses on liability and legal risks, protecting individuals and businesses from financial losses due to accidents or injuries. It includes general liability, professional liability, and umbrella policies. General liability covers third-party claims for bodily injury or property damage. Professional liability addresses errors or omissions in professional services. Risk management strategies, such as implementing safety protocols and conducting regular audits, help mitigate potential risks. The study guide emphasizes understanding these concepts to effectively prepare for the exam, ensuring a solid grasp of casualty insurance principles and their practical applications. Effective risk management is essential for minimizing losses and ensuring compliance with legal requirements.

Homeowners, Auto, and Commercial Insurance Policies

Homeowners, auto, and commercial insurance policies are cornerstone coverages in property and casualty insurance. Homeowners insurance protects against damage to homes and personal property, while auto insurance covers vehicles and liability arising from accidents. Commercial insurance provides tailored coverage for businesses, including liability, property damage, and equipment loss. These policies are essential for managing risks and ensuring financial security. The study guide highlights key features, exclusions, and state-specific requirements for each policy type, helping candidates prepare for licensing exams and understand real-world applications of these coverages in protecting individuals and businesses. This knowledge is crucial for aspiring agents to pass the property and casualty exam and succeed in the industry. Understanding these policies ensures agents can effectively advise clients on appropriate coverage options;

How to Prepare for the Property and Casualty Exam

Utilize a free PDF study guide, practice tests, and flashcards to understand key topics and state-specific requirements, ensuring comprehensive preparation for the exam.

Understanding the Exam Format and Requirements

The Property and Casualty Insurance exam evaluates knowledge of insurance concepts, policies, and state-specific regulations. The exam typically consists of multiple-choice questions, with a focus on liability, property coverage, and risk management. Candidates must understand the exam format, including the number of questions, time limits, and passing score. Utilizing a free PDF study guide and practice tests can help familiarize oneself with the exam structure and content. Proper time management during the exam is crucial, as allocating adequate time to each question ensures thorough responses. Understanding these requirements is key to achieving success.

Study Materials and Resources for Exam Preparation

Effective preparation for the Property and Casualty Insurance exam requires access to reliable study materials. A free PDF study guide is an excellent resource, offering comprehensive coverage of key topics such as liability, property coverage, and risk management. Additionally, practice tests and sample questions are available online, allowing candidates to assess their knowledge and identify areas for improvement. Flashcards and online courses can also enhance learning. Utilizing these resources ensures a well-rounded understanding of the exam content and state-specific requirements, ultimately contributing to exam success. These materials are widely available on official insurance association websites and educational platforms.

Practice Tests and Sample Questions for Self-Assessment

Practice tests and sample questions are invaluable tools for self-assessment in Property and Casualty Insurance exam preparation. These resources simulate real exam conditions, helping candidates evaluate their knowledge and identify gaps. Free PDF guides often include actual exam questions, enabling learners to familiarize themselves with formatting and content. Regular practice reduces exam anxiety and improves time management. Many online platforms offer downloadable practice tests, providing immediate feedback and detailed explanations. Utilizing these tools ensures a comprehensive understanding of key concepts and enhances readiness for the licensing exam. Consistent practice is essential for achieving success.

A free PDF study guide for Property and Casualty Insurance provides comprehensive coverage of key topics, exam tips, and practice questions, aiding effective exam preparation.

Benefits of Using a Free PDF Study Guide

A free PDF study guide offers numerous benefits, including easy accessibility and comprehensive coverage of essential topics. It provides practice questions, exam tips, and state-specific requirements, helping candidates prepare thoroughly. The guide is often searchable, allowing quick access to key terms and concepts. Additionally, it can be downloaded for offline use, making it convenient for studying anywhere. Many guides are updated regularly, ensuring the most current information is available. Using a free PDF study guide is a cost-effective and efficient way to enhance exam preparation and improve understanding of property and casualty insurance concepts.

Where to Find Reliable and Updated Study Materials

Reliable and updated study materials for property and casualty insurance exams can be found on trusted platforms like Open Library and official insurance association websites. Websites such as www.example.com offer free PDF downloads of study guides, sample questions, and exam tips. Additionally, professional associations and networking groups often provide access to exclusive resources. Many authors and educators share free study materials on their websites or through forums. Always verify the source and check for recent updates to ensure the information aligns with current exam requirements and industry standards.

How to Use the PDF Guide Effectively for Exam Success

To maximize the effectiveness of the property and casualty insurance PDF study guide, create a structured study schedule and focus on key topics. Utilize the guide’s search feature to quickly locate specific sections or keywords. Practice with included sample questions to assess your understanding. Review summaries and notes at the end of each chapter to reinforce learning. Highlight important concepts and refer to them frequently. Ensure you understand state-specific requirements and industry standards. By systematically working through the guide and applying its strategies, you can confidently prepare for the exam and achieve success.

Exam Preparation Tips and Strategies

Study regularly, focus on key concepts, and practice with sample questions to assess readiness. Utilize PDF guides and online resources to enhance your preparation effectively.

Time Management and Study Schedules

Effective time management is crucial for success. Create a structured study schedule, allocating specific time slots for each topic. Prioritize key areas like liability and property coverage. Use free PDF guides to focus on high-yield content. Set realistic milestones and track progress. Dedicate time for practice tests to assess understanding. Balance study sessions with breaks to maintain focus. Consistency is key; regular review ensures retention. Adapt your schedule as needed to address weaknesses. By organizing your time wisely, you can efficiently prepare for the exam and achieve your goals.

Understanding Key Topics and State-Specific Requirements

Mastering key topics such as property coverage, liability, and risk management is essential. Additionally, familiarize yourself with state-specific laws and regulations, as these vary by jurisdiction. Free PDF study guides often highlight these differences, ensuring you are well-prepared. Understand policy exclusions, endorsements, and endorsements. Pay attention to vacancy provisions and their impact on coverage. Stay updated on recent changes in insurance laws. Tailor your study materials to include local requirements. This targeted approach ensures comprehensive knowledge and readiness for the exam.

Utilizing Flashcards and Other Study Tools

Flashcards are an excellent way to memorize key terms and concepts for the Property and Casualty Insurance exam. They allow for quick review and retention of important definitions and principles. Many free study guides include flashcard decks or interactive digital tools that simulate real exam questions. Additionally, apps and online platforms offer customizable flashcards tailored to specific topics, such as liability coverage or state-specific regulations. Using these tools regularly can enhance your understanding and improve recall during the exam. Combine flashcards with practice tests for a comprehensive study routine that ensures exam success.

Property and Casualty Insurance Licensing

Obtaining a Property and Casualty Insurance license is crucial for professionals to legally sell insurance policies, ensuring compliance with state regulations and industry standards effectively.

Steps to Obtain a Property and Casualty Insurance License

To obtain a Property and Casualty Insurance license, candidates must meet state-specific prerequisites, complete a pre-licensing course, and pass the licensing exam. After passing, applicants must submit a license application, pay fees, and undergo a background check. Some states require additional steps like fingerprinting. Once licensed, agents must fulfill continuing education requirements to maintain their certification. Utilizing a Property and Casualty study guide PDF can help streamline preparation and ensure success in the licensing process.

Role of the Property and Casualty License in the Industry

A Property and Casualty Insurance license is essential for professionals selling insurance policies, ensuring they possess the necessary knowledge and skills to advise clients effectively. It validates their expertise in managing property and liability risks, fostering trust and credibility with clients. The license also enables agents to operate legally within their state, adhering to industry standards and regulations. In a competitive market, a Property and Casualty license distinguishes qualified professionals, enhancing their career opportunities. Utilizing a Property and Casualty study guide PDF can significantly aid in preparing for the exam and understanding industry expectations.

Continuing Education Requirements for License Renewal

Continuing education (CE) is crucial for Property and Casualty Insurance license renewal, ensuring agents stay updated on industry trends, laws, and ethical practices. Most states require a specific number of CE credits, often focusing on topics like risk management, ethics, and legal updates. Completing these courses helps agents maintain their expertise and comply with regulatory standards. Utilizing a Property and Casualty study guide PDF can supplement CE requirements by providing accessible resources for ongoing learning and professional development in the insurance field.

Risk Management in Property and Casualty Insurance

Risk management involves identifying and assessing potential risks, then implementing strategies to mitigate them, ensuring policyholders are protected against unforeseen events and financial losses.

Identifying and Assessing Risks

Identifying and assessing risks is crucial in property and casualty insurance. This involves evaluating potential threats to property, such as natural disasters or theft, and liability risks, including accidents or legal claims. Insurers use tools like loss histories and industry data to determine risk levels. Vacancy provisions are also key, as extended vacancies can reduce coverage. Understanding these factors helps agents recommend appropriate policies and mitigation strategies, ensuring clients are adequately protected. This process is essential for balancing coverage with premiums, making it a cornerstone of effective risk management in the insurance industry.

Strategies for Mitigating Risks

Effective risk mitigation strategies are essential in property and casualty insurance to minimize potential losses. Regular inspections of properties, installing security systems, and implementing safety protocols are common approaches. Insurers often recommend tailored policies to address specific risks, such as adjusting coverage for vacant properties. Proactive measures like safety training and regular policy reviews can also reduce liability exposure. By understanding and applying these strategies, clients can safeguard their assets while insurers can reduce claims, creating a balanced approach to risk management and financial protection.

Vacancy Provisions and Their Impact on Coverage

Vacancy provisions in property and casualty insurance policies often reduce coverage if a property remains unoccupied beyond a specified period, typically 60 days. These provisions can limit coverage for damage or loss, as insurers consider vacant properties higher risks. For instance, certain coverages like theft or vandalism may be excluded or reduced. Understanding these provisions is crucial for policyholders to avoid gaps in protection. Typically, vacancy is defined as the absence of both people and personal property. Some policies, such as farm policies, may have extended vacancy periods, up to 120 days, before coverage is impacted.

Additional Resources for Aspiring Agents

Free webinars, online courses, and eBooks provide comprehensive insights into property and casualty insurance. Professional associations and networking opportunities further enhance knowledge and career growth in the industry.

Free Webinars and Online Courses

Free webinars and online courses offer in-depth insights into property and casualty insurance, covering exam preparation, industry trends, and practical knowledge. These resources are designed to help aspiring agents understand key concepts, such as risk management and state-specific requirements. Platforms like the American Insurance Association and other insurance education providers offer these tools, ensuring accessibility and flexibility for learners. Webinars often feature expert Q&A sessions, while online courses provide structured learning paths. They are invaluable for gaining the knowledge needed to pass the licensing exam and succeed in the insurance industry.

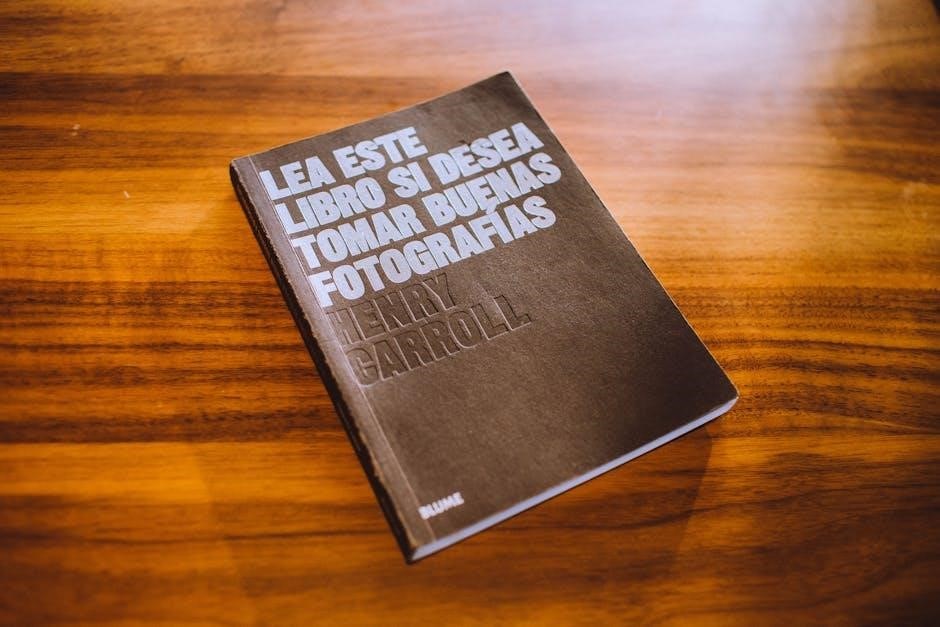

Insurance Exam Guides and eBooks

Insurance exam guides and eBooks are essential resources for preparing for the property and casualty licensing exam. These materials provide comprehensive coverage of key topics, including property insurance, liability risks, and state-specific requirements. Many guides offer practice tests, sample questions, and detailed explanations to help candidates understand complex concepts. eBooks often include real-world examples and case studies, making learning more engaging. Additionally, they are frequently updated to reflect industry changes, ensuring candidates have the most current information. These resources are widely available for free download, making them accessible and affordable for aspiring agents.

Professional Associations and Networking Opportunities

Professional associations and networking opportunities play a crucial role in the success of aspiring property and casualty insurance agents. Joining organizations like the American Insurance Association (AIA) or the National Association of Insurance Commissioners (NAIC) provides access to industry insights, training resources, and networking events. These groups often offer free or discounted study materials, webinars, and workshops, which can be invaluable for exam preparation. Networking with experienced professionals can also open doors to mentorship opportunities and job placements. Staying connected with industry leaders and peers helps agents stay updated on the latest trends and regulatory changes, ensuring long-term career growth and success.

Passing the Property and Casualty Insurance exam requires dedication and the right resources. Utilize study guides, practice tests, and continuous learning to achieve success and advance your career.

Final Tips for Passing the Property and Casualty Exam

To ensure success, utilize free PDF study guides and practice tests to reinforce key concepts. Develop a study schedule and focus on understanding state-specific requirements. Flashcards can help memorize terms and definitions. Review sample questions to familiarize yourself with the exam format. Stay calm and manage your time effectively during the test. Continuous learning and industry updates will enhance your knowledge and career growth in property and casualty insurance. By following these strategies, you can confidently pass the exam and advance your professional goals in the insurance field.

The Importance of Continuous Learning in the Insurance Industry

Continuous learning is crucial in the insurance industry due to evolving regulations, emerging risks, and market trends. Professionals must stay updated on policy changes, legal requirements, and new products to remain competitive. Free resources like PDF study guides, webinars, and online courses provide accessible ways to expand knowledge. Additionally, joining professional associations and networking with peers can offer insights and opportunities for growth. By committing to lifelong learning, insurance professionals can adapt to industry shifts, enhance their expertise, and deliver better services to clients, ensuring long-term success and credibility in their careers.