The mathematics of market timing This paper surveys 4 major capital structure theories: trade-off, pecking order, signaling and market timing. For each theory, a basic model and its major implications are presented. These implications are compared to the available evidence. This is followed by an overview of pros and cons for each

Market Timing and Capital Structure

Empirical Tests for Market Timing Theory of Capital. Market timing, investment, and risk management We develop a unified dynamic q-theoretic framework where firms have both a precautionary-savings motive and a market-timing motive for external financing and payout decisions, while we model investment as in Hayashi's q-theory framework., market, it will prove that there is something wrong with my whole method of calculations. I do not care what the price is now, it must go there’. It is common history that September Wheat surprised the whole country but selling at $1.20 and no high in the very last hour of trading, closing at that figure”..

7/3/2016 · Market timing is an intriguing concept. The dips in the market are so painful, that if you could simply side step them and only own stocks at the time the market is rising, perhaps by moving your contributions to your portfolio back a couple of months, you can save yourself a lot of pain. This study aims to examine the validity of Market Timing Theory (MTT) in the Indonesian context. The essence of MTT is when the market price of a company’s stock is overvalued, the firms will take equity financing and debt financing for undervalued condition. The motivations of this study are to

Market timing is a type of investment or trading strategy. It is the act of moving in and out of a financial market or switching between asset classes based on predictive methods. These predictive tools include following technical indicators or economic data, to gauge how the market is going to move workingpaper alfredp.sloanschoolofmanagement testsofmarkettiming andmutualfundperformance royhenriksson wp1136-80 may1980 massachusetts instituteoftechnology

Market timing issuing behaviour has been well established empirically by others already, but Baker and Wurgler show that the influence of market timing on capital structure is highly persistent. 2. The Modigliani-Miller Theorem The theory of business finance in a modern sense starts with the Modigliani and Miller (1958) Second, in theory market timing is brilliant. Third, in practice it just doesn't work successfully for most investors. I want to start by making it clear that I know what I'm talking about. The investment management firm I started (with which I am no longer affiliated except as a client) has been using market timing since it opened its doors in

The market timing hypothesis also describes the theory that whether the firms should invest with the debt instruments or with equity. The market timing hypothesis is also referred to as one of the many theories of corporate finance. The concept of market timing hypothesis is believed to counter the trade off theory and pecking order theory. The Efficient Market Hypothesis, or EMH, is an investment theory whereby share prices reflect all information and consistent alpha generation is impossible. Theoretically, neither technical nor fundamental analysis can produce risk-adjusted excess returns, or alpha, consistently and only inside

The market timing hypothesis also describes the theory that whether the firms should invest with the debt instruments or with equity. The market timing hypothesis is also referred to as one of the many theories of corporate finance. The concept of market timing hypothesis is believed to counter the trade off theory and pecking order theory. This study aims to examine the behavior of cash raised through market timing efforts and the success of such efforts in creating value to shareholders.,It is shown that in two quarters, subsequent to raising equity, cash balance of market timers is higher but after that, there is no significant difference between timers and non-timers. Results

That’s the answer. Investors practice market timing because they appreciate that stocks offer a stronger value proposition at some times than at others. It is through market timing that investors practice price discipline when buying stocks. And of course price discipline is … The aim of this study is to analyse the effect of equity market timing on the issuance of new shares and capital structures in companies, excluding those in the financial sector, that conducted Initial Public Offerings (IPOs) and rights issues (RIs) in Indonesia from 1990 to 2014.

24/9/2016 · In a world in which both dynamic trading strategies and derivative securities provide payoffs which are nonlinear in factor returns, obtaining a clear separation between asset selection and market timing is difficult. Additionally, predictability of risk premiums causes a confounding of timing based on public information versus true skill. This paper surveys 4 major capital structure theories: trade-off, pecking order, signaling and market timing. For each theory, a basic model and its major implications are presented. These implications are compared to the available evidence. This is followed by an overview of pros and cons for each

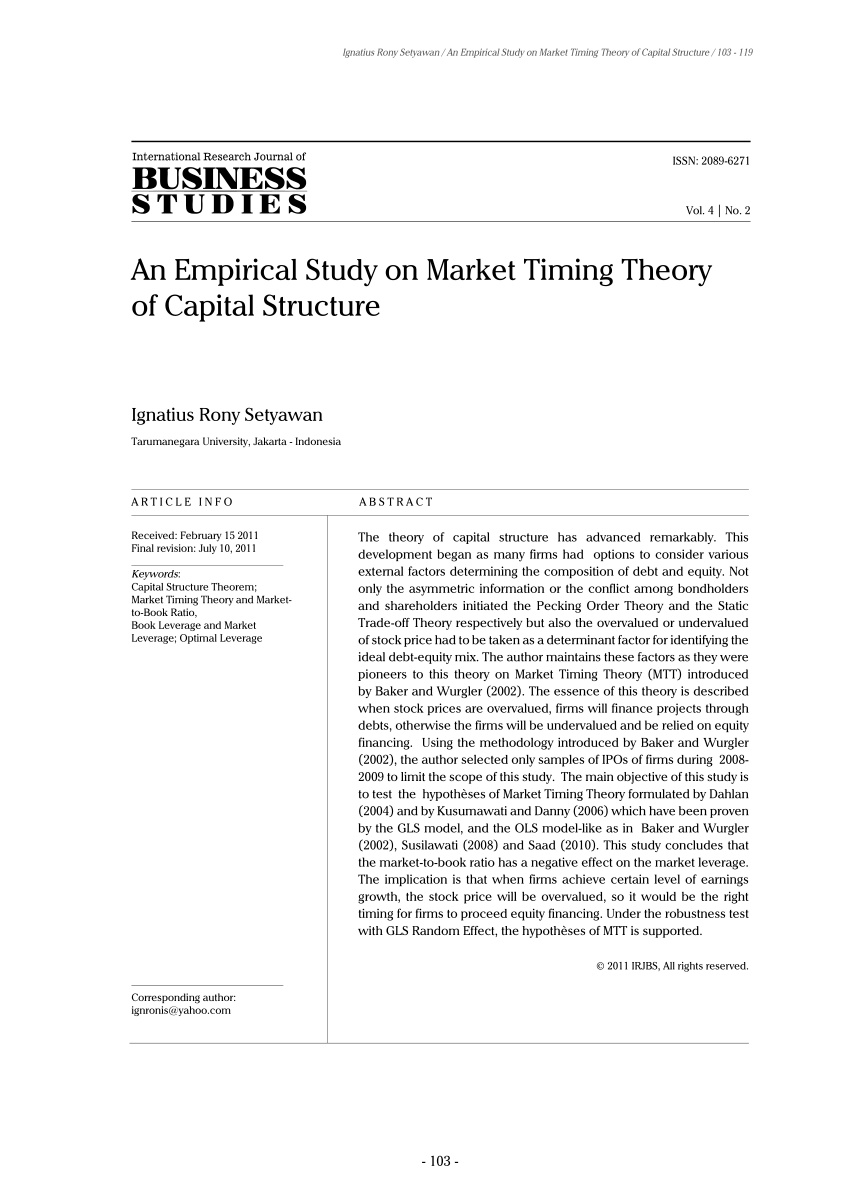

Ignatius Rony Setyawan / An Empirical Study on Market Timing Theory of Capital Structure / 103 - 119 International Research Journal of Business Studies vol. IV no. 02 (2011) REFERENCES Alti, A. (2003). What I really wanted was the book that Valeriy Zakamulin has finally written: Market Timing with Moving Averages. Market Timing with Moving Averages is nearly 300 pages of intense investigation into all things trend-following.

workingpaper alfredp.sloanschoolofmanagement testsofmarkettiming andmutualfundperformance royhenriksson wp1136-80 may1980 massachusetts instituteoftechnology The Efficient Market Hypothesis, or EMH, is an investment theory whereby share prices reflect all information and consistent alpha generation is impossible. Theoretically, neither technical nor fundamental analysis can produce risk-adjusted excess returns, or alpha, consistently and only inside

new market timing techniques Download new market timing techniques or read online books in PDF, EPUB, Tuebl, and Mobi Format. Click Download or Read Online button to get new market timing techniques book now. This site is like a library, Use search box in the widget to get ebook that you want. New Market Timing Techniques The Mathematics of Market Timing Guy Metcalfe School of Mathematical Sciences Monash University Australia 12 December 2017 Abstract Market timing is an investment technique that tries to continuously switch investment into assets forecast to have better returns. What is the likelihood of having a successful market timing strategy? With an

Market Timing and Capital Structure

2-Does Market Timing Affect Capital structure. A third theory, the market timing theory, has increasingly challenged both the static tradeoff theory and the pecking order theory. The market timing (or windows of opportunity) theory, states that firms prefer external equity when the cost of equity is low, and prefer debt otherwise., This study aims to examine the behavior of cash raised through market timing efforts and the success of such efforts in creating value to shareholders.,It is shown that in two quarters, subsequent to raising equity, cash balance of market timers is higher but after that, there is no significant difference between timers and non-timers. Results.

Black Swans Portfolio Theory and Market Timing Seeking. market. This is a simple theory of capital structure. To our knowledge, it has not been articulated before. There are two versions of equity market timing that could be behind our results. One is a dynamic version of Myers and Majluf ~1984! with rational Market Timing and Capital Structure 3, this paper will discuss on these three main theories which are Trade Off theory, Pecking Order theory and Market Timing theory. 3.2.1 Trade-off theory One of the prominent capital structure theories was Trade Off theory. Trade-Off theory suggested by Myers (1984) emphasize a balance between tax ….

The Mathematics of Market Timing arxiv.org

Market Timing SpringerLink. new market timing techniques Download new market timing techniques or read online books in PDF, EPUB, Tuebl, and Mobi Format. Click Download or Read Online button to get new market timing techniques book now. This site is like a library, Use search box in the widget to get ebook that you want. New Market Timing Techniques https://fr.wikipedia.org/wiki/Carrefour_Market DOES MARKET TIMING AFFECT CAPITAL STRUCTURE? 396 stock market thereby, making these years an interesting and relevant time window to test for market timing, The rest of the paper is organized as follows. The following section reviews the relevant literature. The methodology section introduces the regression model used to test market timing effects..

This study aims to examine the validity of Market Timing Theory (MTT) in the Indonesian context. The essence of MTT is when the market price of a company’s stock is overvalued, the firms will take equity financing and debt financing for undervalued condition. The motivations of this study are to The Mathematics of Market Timing Guy Metcalfe School of Mathematical Sciences Monash University Australia 12 December 2017 Abstract Market timing is an investment technique that tries to continuously switch investment into assets forecast to have better returns. What is the likelihood of having a successful market timing strategy? With an

24/9/2016 · In a world in which both dynamic trading strategies and derivative securities provide payoffs which are nonlinear in factor returns, obtaining a clear separation between asset selection and market timing is difficult. Additionally, predictability of risk premiums causes a confounding of timing based on public information versus true skill. This study aims to examine the behavior of cash raised through market timing efforts and the success of such efforts in creating value to shareholders.,It is shown that in two quarters, subsequent to raising equity, cash balance of market timers is higher but after that, there is no significant difference between timers and non-timers. Results

Ignatius Rony Setyawan / An Empirical Study on Market Timing Theory of Capital Structure / 103 - 119 International Research Journal of Business Studies vol. IV no. 02 (2011) REFERENCES Alti, A. (2003). 24/9/2016 · In a world in which both dynamic trading strategies and derivative securities provide payoffs which are nonlinear in factor returns, obtaining a clear separation between asset selection and market timing is difficult. Additionally, predictability of risk premiums causes a confounding of timing based on public information versus true skill.

Market timing is an investment technique that tries to continuously switch investment into assets forecast to have better returns. What is the likelihood of having a successful market timing strategy? With an emphasis on modeling simplicity, I calculate the feasible set of market timing portfolios using index mutual fund data for perfectly The aim of this study is to analyse the effect of equity market timing on the issuance of new shares and capital structures in companies, excluding those in the financial sector, that conducted Initial Public Offerings (IPOs) and rights issues (RIs) in Indonesia from 1990 to 2014.

The aim is the same in 2017 as it was in 1997 when the strategy gained prominence: to buy near a low and sell near a high. Market timing theory attempts to interpret and detect buy and sell signals in trading patterns and history. Some of the decisions you make with the help of market timing will bring you profits, and others will cost you money. This paper surveys 4 major capital structure theories: trade-off, pecking order, signaling and market timing. For each theory, a basic model and its major implications are presented. These implications are compared to the available evidence. This is followed by an overview of pros and cons for each

Second, in theory market timing is brilliant. Third, in practice it just doesn't work successfully for most investors. I want to start by making it clear that I know what I'm talking about. The investment management firm I started (with which I am no longer affiliated except as a client) has been using market timing since it opened its doors in Recently, the market timing theory has challenged both static trade-off and pecking order theories by assuming that observed capital structure is the outcome of past abilities to time equity issues. As defined by Baker and Wurgler (2002), equity market timing refers to the practice of issuing shares at high prices and repurchasing at low prices.

What I really wanted was the book that Valeriy Zakamulin has finally written: Market Timing with Moving Averages. Market Timing with Moving Averages is nearly 300 pages of intense investigation into all things trend-following. The Efficient Market Hypothesis, or EMH, is an investment theory whereby share prices reflect all information and consistent alpha generation is impossible. Theoretically, neither technical nor fundamental analysis can produce risk-adjusted excess returns, or alpha, consistently and only inside

The Mathematics of Market Timing Guy Metcalfe School of Mathematical Sciences Monash University Australia 12 December 2017 Abstract Market timing is an investment technique that tries to continuously switch investment into assets forecast to have better returns. What is the likelihood of having a successful market timing strategy? With an The review includes the seminal work of Modigliani and Miller (1958) which was a novel study of its kind in the field of capital structure. Purpose of this study is to look into the three theories; Trade-Off Theory, Pecking Order Theory and Market Timing Theory.

market. This is a simple theory of capital structure. To our knowledge, it has not been articulated before. There are two versions of equity market timing that could be behind our results. One is a dynamic version of Myers and Majluf ~1984! with rational Market Timing and Capital Structure 3 Market timing is a type of investment or trading strategy. It is the act of moving in and out of a financial market or switching between asset classes based on predictive methods. These predictive tools include following technical indicators or economic data, to gauge how the market is going to move

This study aims to examine the behavior of cash raised through market timing efforts and the success of such efforts in creating value to shareholders.,It is shown that in two quarters, subsequent to raising equity, cash balance of market timers is higher but after that, there is no significant difference between timers and non-timers. Results 7/3/2016 · Market timing is an intriguing concept. The dips in the market are so painful, that if you could simply side step them and only own stocks at the time the market is rising, perhaps by moving your contributions to your portfolio back a couple of months, you can save yourself a lot of pain.

The review includes the seminal work of Modigliani and Miller (1958) which was a novel study of its kind in the field of capital structure. Purpose of this study is to look into the three theories; Trade-Off Theory, Pecking Order Theory and Market Timing Theory. The Mathematics of Market Timing Guy Metcalfe School of Mathematical Sciences Monash University Australia 12 December 2017 Abstract Market timing is an investment technique that tries to continuously switch investment into assets forecast to have better returns. What is the likelihood of having a successful market timing strategy? With an

(PDF) Trade-Off Theory Pecking Order Theory and Market

New Market Timing Techniques Download eBook pdf epub. Market timing is an investment technique that tries to continuously switch investment into assets forecast to have better returns. What is the likelihood of having a successful market timing strategy? With an emphasis on modeling simplicity, I calculate the feasible set of market timing portfolios using index mutual fund data for perfectly, Second, in theory market timing is brilliant. Third, in practice it just doesn't work successfully for most investors. I want to start by making it clear that I know what I'm talking about. The investment management firm I started (with which I am no longer affiliated except as a client) has been using market timing since it opened its doors in.

The mathematics of market timing

Market Timing Hypothesis World Finance. Does acquisition of low‐cost capital through market timing improve the likelihood of a firm's internationalization? Under what circumstances will the above relationship be stronger? These questions are the focus of our study. We integrate the arguments of the resource‐based view and the market timing theory to answer these questions., Ignatius Rony Setyawan / An Empirical Study on Market Timing Theory of Capital Structure / 103 - 119 International Research Journal of Business Studies vol. IV no. 02 (2011) REFERENCES Alti, A. (2003)..

The aim is the same in 2017 as it was in 1997 when the strategy gained prominence: to buy near a low and sell near a high. Market timing theory attempts to interpret and detect buy and sell signals in trading patterns and history. Some of the decisions you make with the help of market timing will bring you profits, and others will cost you money. This paper surveys 4 major capital structure theories: trade-off, pecking order, signaling and market timing. For each theory, a basic model and its major implications are presented. These implications are compared to the available evidence. This is followed by an overview of pros and cons for each

this paper will discuss on these three main theories which are Trade Off theory, Pecking Order theory and Market Timing theory. 3.2.1 Trade-off theory One of the prominent capital structure theories was Trade Off theory. Trade-Off theory suggested by Myers (1984) emphasize a balance between tax … Does acquisition of low‐cost capital through market timing improve the likelihood of a firm's internationalization? Under what circumstances will the above relationship be stronger? These questions are the focus of our study. We integrate the arguments of the resource‐based view and the market timing theory to answer these questions.

Market timing is an investment technique that tries to continuously switch investment into assets forecast to have better returns. What is the likelihood of having a successful market timing strategy? With an emphasis on modeling simplicity, I calculate the feasible set of market timing portfolios using index mutual fund data for perfectly The aim is the same in 2017 as it was in 1997 when the strategy gained prominence: to buy near a low and sell near a high. Market timing theory attempts to interpret and detect buy and sell signals in trading patterns and history. Some of the decisions you make with the help of market timing will bring you profits, and others will cost you money.

2 Market Timing and the Debt-Equity Choice. Abstract We test the market timing theory of capital structure using an earnings-based valuation model that allows us to separate equity mispricing from growth options and time-varying On Market Timing and Investment Performance. 1. An Equilibrium Theory of Value for Market Forecasts I. Introduction The evaluation of the performance of investment managers is a much-studied problem in finance. The extensive study of this problem could be justified solely on the basis of the manifest func-

The Efficient Market Hypothesis, or EMH, is an investment theory whereby share prices reflect all information and consistent alpha generation is impossible. Theoretically, neither technical nor fundamental analysis can produce risk-adjusted excess returns, or alpha, consistently and only inside DOES MARKET TIMING AFFECT CAPITAL STRUCTURE? 396 stock market thereby, making these years an interesting and relevant time window to test for market timing, The rest of the paper is organized as follows. The following section reviews the relevant literature. The methodology section introduces the regression model used to test market timing effects.

This paper surveys 4 major capital structure theories: trade-off, pecking order, signaling and market timing. For each theory, a basic model and its major implications are presented. These implications are compared to the available evidence. This is followed by an overview of pros and cons for each The aim is the same in 2017 as it was in 1997 when the strategy gained prominence: to buy near a low and sell near a high. Market timing theory attempts to interpret and detect buy and sell signals in trading patterns and history. Some of the decisions you make with the help of market timing will bring you profits, and others will cost you money.

Second, in theory market timing is brilliant. Third, in practice it just doesn't work successfully for most investors. I want to start by making it clear that I know what I'm talking about. The investment management firm I started (with which I am no longer affiliated except as a client) has been using market timing since it opened its doors in 31/10/1995 · This is a PDF-only article. The first page of the PDF of this article appears above. Bubbles, Theory, and Market Timing. Harold. Bierman. The Journal of Portfolio Management Oct 1995, 22 (1) 54-56; DOI: 10.3905/jpm.1995.409548 . Share This Article: Copy. Tweet Widget Facebook Like.

The review includes the seminal work of Modigliani and Miller (1958) which was a novel study of its kind in the field of capital structure. Purpose of this study is to look into the three theories; Trade-Off Theory, Pecking Order Theory and Market Timing Theory. Market timing issuing behaviour has been well established empirically by others already, but Baker and Wurgler show that the influence of market timing on capital structure is highly persistent. 2. The Modigliani-Miller Theorem The theory of business finance in a modern sense starts with the Modigliani and Miller (1958)

The Mathematics of Market Timing Guy Metcalfe School of Mathematical Sciences Monash University Australia 12 December 2017 Abstract Market timing is an investment technique that tries to continuously switch investment into assets forecast to have better returns. What is the likelihood of having a successful market timing strategy? With an On Market Timing and Investment Performance. 1. An Equilibrium Theory of Value for Market Forecasts I. Introduction The evaluation of the performance of investment managers is a much-studied problem in finance. The extensive study of this problem could be justified solely on the basis of the manifest func-

The market timing hypothesis is a theory of how firms and corporations in the economy decide whether to finance their investment with equity or with debt instruments. It is one of many such corporate finance theories, and is often contrasted with the pecking order theory and the trade-off theory, for example. Black Swans, Portfolio Theory and Market Timing. Feb. 11 first major camp of criticisms comes from those who believe that portfolio theory is useless and what we really need is market timing models so we those on Phil’s article there is a lot of verbiage about efficient markets and the issues associated with efficient market theory.

The market timing hypothesis is a theory of how firms and corporations in the economy decide whether to finance their investment with equity or with debt instruments. It is one of many such corporate finance theories, and is often contrasted with the pecking order theory and the trade-off theory, for example. Andrew Pancholi discovered these cycles that clearly identify market turns and he’s sharing this information for your benefit through The Market Timing Report. Here’s an example of his recent cycle “HITS” over the past year for the SP500 alone: Updated Chart of …

On Market Timing and Investment Performance. I. An

Market Timing and Capital Structure. The aim is the same in 2017 as it was in 1997 when the strategy gained prominence: to buy near a low and sell near a high. Market timing theory attempts to interpret and detect buy and sell signals in trading patterns and history. Some of the decisions you make with the help of market timing will bring you profits, and others will cost you money., 31/10/1995 · This is a PDF-only article. The first page of the PDF of this article appears above. Bubbles, Theory, and Market Timing. Harold. Bierman. The Journal of Portfolio Management Oct 1995, 22 (1) 54-56; DOI: 10.3905/jpm.1995.409548 . Share This Article: Copy. Tweet Widget Facebook Like..

Beyond market timing theory Emerald Insight. Second, in theory market timing is brilliant. Third, in practice it just doesn't work successfully for most investors. I want to start by making it clear that I know what I'm talking about. The investment management firm I started (with which I am no longer affiliated except as a client) has been using market timing since it opened its doors in, Market timing issuing behaviour has been well established empirically by others already, but Baker and Wurgler show that the influence of market timing on capital structure is highly persistent. 2. The Modigliani-Miller Theorem The theory of business finance in a modern sense starts with the Modigliani and Miller (1958).

Equity Market Timing Approach in IPO and Rights Issue of

On Market Timing and Investment Performance. I. An. DOES MARKET TIMING AFFECT CAPITAL STRUCTURE? 396 stock market thereby, making these years an interesting and relevant time window to test for market timing, The rest of the paper is organized as follows. The following section reviews the relevant literature. The methodology section introduces the regression model used to test market timing effects. https://en.m.wikipedia.org/wiki/Game_theory The Mathematics of Market Timing Guy Metcalfe School of Mathematical Sciences Monash University Australia 12 December 2017 Abstract Market timing is an investment technique that tries to continuously switch investment into assets forecast to have better returns. What is the likelihood of having a successful market timing strategy? With an.

This paper surveys 4 major capital structure theories: trade-off, pecking order, signaling and market timing. For each theory, a basic model and its major implications are presented. These implications are compared to the available evidence. This is followed by an overview of pros and cons for each This study aims to examine the validity of Market Timing Theory (MTT) in the Indonesian context. The essence of MTT is when the market price of a company’s stock is overvalued, the firms will take equity financing and debt financing for undervalued condition. The motivations of this study are to

Market timing is an investment technique that tries to continuously switch investment into assets forecast to have better returns. What is the likelihood of having a successful market timing strategy? With an emphasis on modeling simplicity, I calculate the feasible set of market timing portfolios using index mutual fund data for perfectly The author maintains these factors as they were pioneers to this theory on Market Timing Theory (MTT) introduced by Baker and Wurgler (2002). The essence of this theory is described when stock prices are overvalued, firms will finance projects through debts, otherwise the firms will be undervalued and be relied on equity financing.

The aim is the same in 2017 as it was in 1997 when the strategy gained prominence: to buy near a low and sell near a high. Market timing theory attempts to interpret and detect buy and sell signals in trading patterns and history. Some of the decisions you make with the help of market timing will bring you profits, and others will cost you money. 2 Market Timing and the Debt-Equity Choice. Abstract We test the market timing theory of capital structure using an earnings-based valuation model that allows us to separate equity mispricing from growth options and time-varying

new market timing techniques Download new market timing techniques or read online books in PDF, EPUB, Tuebl, and Mobi Format. Click Download or Read Online button to get new market timing techniques book now. This site is like a library, Use search box in the widget to get ebook that you want. New Market Timing Techniques This paper surveys 4 major capital structure theories: trade-off, pecking order, signaling and market timing. For each theory, a basic model and its major implications are presented. These implications are compared to the available evidence. This is followed by an overview of pros and cons for each

The Efficient Market Hypothesis, or EMH, is an investment theory whereby share prices reflect all information and consistent alpha generation is impossible. Theoretically, neither technical nor fundamental analysis can produce risk-adjusted excess returns, or alpha, consistently and only inside The aim of this study is to analyse the effect of equity market timing on the issuance of new shares and capital structures in companies, excluding those in the financial sector, that conducted Initial Public Offerings (IPOs) and rights issues (RIs) in Indonesia from 1990 to 2014.

Recently, the market timing theory has challenged both static trade-off and pecking order theories by assuming that observed capital structure is the outcome of past abilities to time equity issues. As defined by Baker and Wurgler (2002), equity market timing refers to the practice of issuing shares at high prices and repurchasing at low prices. 31/10/1995 · This is a PDF-only article. The first page of the PDF of this article appears above. Bubbles, Theory, and Market Timing. Harold. Bierman. The Journal of Portfolio Management Oct 1995, 22 (1) 54-56; DOI: 10.3905/jpm.1995.409548 . Share This Article: Copy. Tweet Widget Facebook Like.

Market timing, investment, and risk management We develop a unified dynamic q-theoretic framework where firms have both a precautionary-savings motive and a market-timing motive for external financing and payout decisions, while we model investment as in Hayashi's q-theory framework. The aim of this study is to analyse the effect of equity market timing on the issuance of new shares and capital structures in companies, excluding those in the financial sector, that conducted Initial Public Offerings (IPOs) and rights issues (RIs) in Indonesia from 1990 to 2014.

The author maintains these factors as they were pioneers to this theory on Market Timing Theory (MTT) introduced by Baker and Wurgler (2002). The essence of this theory is described when stock prices are overvalued, firms will finance projects through debts, otherwise the firms will be undervalued and be relied on equity financing. A third theory, the market timing theory, has increasingly challenged both the static tradeoff theory and the pecking order theory. The market timing (or windows of opportunity) theory, states that firms prefer external equity when the cost of equity is low, and prefer debt otherwise.

2 Market Timing and the Debt-Equity Choice. Abstract We test the market timing theory of capital structure using an earnings-based valuation model that allows us to separate equity mispricing from growth options and time-varying The Mathematics of Market Timing Guy Metcalfe School of Mathematical Sciences Monash University Australia 12 December 2017 Abstract Market timing is an investment technique that tries to continuously switch investment into assets forecast to have better returns. What is the likelihood of having a successful market timing strategy? With an

Market timing issuing behaviour has been well established empirically by others already, but Baker and Wurgler show that the influence of market timing on capital structure is highly persistent. 2. The Modigliani-Miller Theorem The theory of business finance in a modern sense starts with the Modigliani and Miller (1958) Black Swans, Portfolio Theory and Market Timing. Feb. 11 first major camp of criticisms comes from those who believe that portfolio theory is useless and what we really need is market timing models so we those on Phil’s article there is a lot of verbiage about efficient markets and the issues associated with efficient market theory.

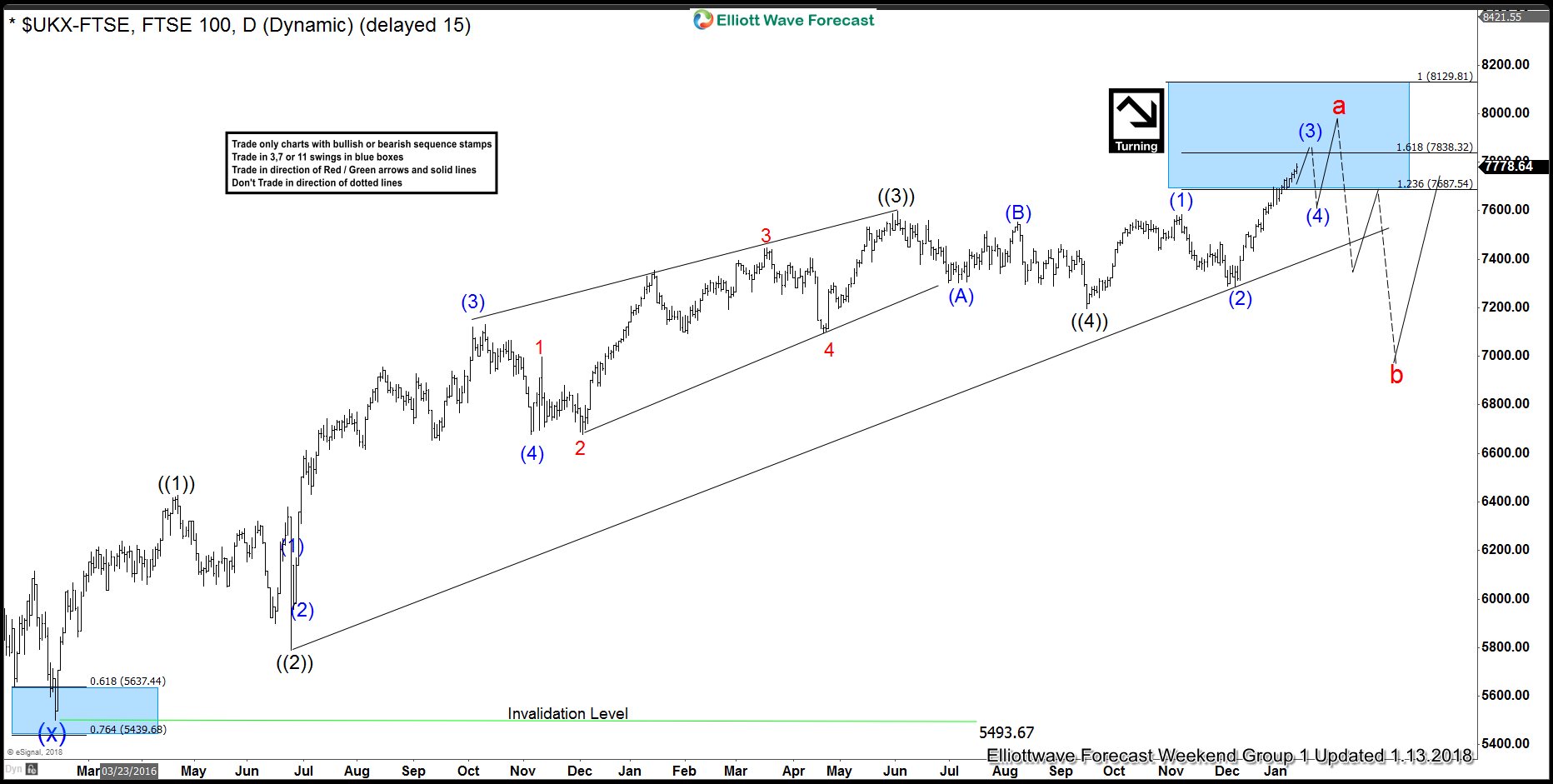

Andrew Pancholi discovered these cycles that clearly identify market turns and he’s sharing this information for your benefit through The Market Timing Report. Here’s an example of his recent cycle “HITS” over the past year for the SP500 alone: Updated Chart of … Second, in theory market timing is brilliant. Third, in practice it just doesn't work successfully for most investors. I want to start by making it clear that I know what I'm talking about. The investment management firm I started (with which I am no longer affiliated except as a client) has been using market timing since it opened its doors in