Know the Law in Franchise Business Franchise Philippines Guide to Philippines Tax Law Research; Tax Guide on Philippine Taxation; International Tax Matters. TAX GUIDE ON PHILIPPINE TAXATION. LAWS . THE CONSTITUTION OF THE PHILIPPINES (constitutional limitations) Organization and Function of the Bureau of Internal Revenue. Title I, NIRC. Tax Code . Income Tax. Title II, NIRC. Tax Code .

How to Organize and Register a Corporation in the Philippines

Guide to Setting Up a Company in the Philippines 2019. 3/1/2019В В· Constitutional Law 1 is the first of the many subjects that fall under Political Law. Political Law, on the other hand is typically the first exam given on the morning of the first Sunday of the, 1/18/2019В В· Criminal Law II is a very, very long subject, kapatid. The most important piece of advice I can give you is that there is a very, very strong probability that your class will not finish the course..

12/16/2015 · Food Law Guide - Philippines Medical Devices are Subject to New Notification and Registration Requirements in the Philippines * Food Law Guide - Thailand * - … 12/16/2015 · Food Law Guide - Philippines Medical Devices are Subject to New Notification and Registration Requirements in the Philippines * Food Law Guide - Thailand * - …

9/17/2019В В· One essential information in business is knowing the law and how to apply it to avoid problems upon running a business. Basic law in business is a must to know for you to manage your franchise in a right path. One reason why some franchisee failed to run their business successfully is because they are not aware of the basic law. 3/1/2019В В· Constitutional Law 1 is the first of the many subjects that fall under Political Law. Political Law, on the other hand is typically the first exam given on the morning of the first Sunday of the

subject to a 20% final withholding tax except for long-term time deposits of five (5) years the beginning of the fourth taxable year immediately following the commencement . PKF Worldwide Tax Guide 2012 Philippines. PKF Worldwide Tax Guide 2012. PKF Worldwide Tax Guide 2012. PKF Worldwide Tax Guide 2012. PKF Worldwide Tax Guide 2012 4/14/2016В В· Under Philippine law, a corporation is an artificial being created by operation of law, having the right of succession and the powers, attributes and properties expressly authorized by law or incident to its existence. 1 Corporations may be classified as either stock or non-stock corporations. Stock

Guide to Philippines Tax Law Research; Tax Guide on Philippine Taxation; International Tax Matters. TAX GUIDE ON PHILIPPINE TAXATION. LAWS . THE CONSTITUTION OF THE PHILIPPINES (constitutional limitations) Organization and Function of the Bureau of Internal Revenue. Title I, NIRC. Tax Code . Income Tax. Title II, NIRC. Tax Code . 8/20/2019В В· Aside from tax amnesty the law also gives some other benefits for the taxpayers who will apply the law in their favor. They are as follows: Immunities from all penalties for taxable year 2017 and prior years for estate taxes that are not yet paid and the penalties for non-payment thereof.

However, the Philippines has more to offer than an attractive coastline; those who study in the Philippines will be able to explore its fascinating mix of Islamic, Malay, Spanish and American influences on Filipino culture. Read on to find out about the top universities in the … 9/25/2019 · About The World Travel Guide. The World Travel Guide (WTG) is the flagship digital consumer brand within the Columbus Travel Media portfolio. A comprehensive guide to the world’s best travel destinations, its print heritage stretches back more than 30 years, with the online portal reaching its 20-year anniversary in 2019.

Your guide to paying inheritance tax in the Philippines. TransferWise. What’s inheritance tax in the Philippines? Inheritance tax is a tax placed on estates or assets that are passed on via a will of a deceased or the law of succession. In the Philippines, the government refers to … Under the Philippines’ minimum wage law, the minimum wage rate varies from one region of the Guide to Philippine Employment Law: An Overview of Employment Laws for the Private Sector Quisumbing Torres 3 Furthermore, employers may not require employees to …

3/16/2018 · Detailed description of corporate withholding taxes in Philippines. Corporations and individuals engaged in business are required to withhold the appropriate tax on income payments to non-residents, generally at the rate of 30% in the case of payments to non-resident foreign corporations or 25% for non-resident aliens not engaged in trade or business. Under the Philippines’ minimum wage law, the minimum wage rate varies from one region of the Guide to Philippine Employment Law: An Overview of Employment Laws for the Private Sector Quisumbing Torres 3 Furthermore, employers may not require employees to …

subject to a 20% final withholding tax except for long-term time deposits of five (5) years the beginning of the fourth taxable year immediately following the commencement . PKF Worldwide Tax Guide 2012 Philippines. PKF Worldwide Tax Guide 2012. PKF Worldwide Tax Guide 2012. PKF Worldwide Tax Guide 2012. PKF Worldwide Tax Guide 2012 12/16/2015 · Food Law Guide - Philippines Medical Devices are Subject to New Notification and Registration Requirements in the Philippines * Food Law Guide - Thailand * - …

9/19/2019В В· From the Rule of Law in Armed Conflict Project. Includes adherence information on treaties in the following subject areas: humanitarian law, human rights law, weapons, refugees, criminal law and terrorism. Also includes links to international court and tribunal decisions. << 7/17/2019В В· Browse through brief employment and labor law updates from around the globe. Contact a Littler attorney for more information or view our global locations.View all Q2 2019 Global Guide Quarterly updates Download full Q2 2019 Global Guide Quarterly

Looking for so much information on working and living in the Philippines is rather bothersome and requires a lot of time. The InterNations Expat Guide for the Philippines is designed to help you and offers trusted information on all issues of interest to expats living in the Philippines. Guide to Philippines Tax Law Research; Tax Guide on Philippine Taxation; International Tax Matters. TAX GUIDE ON PHILIPPINE TAXATION. LAWS . THE CONSTITUTION OF THE PHILIPPINES (constitutional limitations) Organization and Function of the Bureau of Internal Revenue. Title I, NIRC. Tax Code . Income Tax. Title II, NIRC. Tax Code .

Get this from a library! Subject guide to Presidential decrees and other presidential issuances (from the Proclamation of martial law up to June 1975). [Myrna S Feliciano; … Get this from a library! Subject guide to Presidential decrees and other presidential issuances (from the Proclamation of martial law up to June 1975). [Myrna S Feliciano; …

The present income tax law in the Philippines Answers

[LAW SCHOOL PHILIPPINES] What to Expect in Law School. Get this from a library! Subject guide to Presidential decrees and other presidential issuances (from the Proclamation of martial law up to June 1975). [Myrna S Feliciano; …, 4/14/2016 · Under Philippine law, a corporation is an artificial being created by operation of law, having the right of succession and the powers, attributes and properties expressly authorized by law or incident to its existence. 1 Corporations may be classified as either stock or non-stock corporations. Stock.

Most Popular Law Schools in Asia 2019 LLM GUIDE

Guide to Setting Up a Company in the Philippines 2019. 3/1/2019 · Constitutional Law 1 is the first of the many subjects that fall under Political Law. Political Law, on the other hand is typically the first exam given on the morning of the first Sunday of the https://en.m.wikipedia.org/wiki/Spanish_language_in_the_Philippines However, the Philippines has more to offer than an attractive coastline; those who study in the Philippines will be able to explore its fascinating mix of Islamic, Malay, Spanish and American influences on Filipino culture. Read on to find out about the top universities in the ….

Complete guide to setting up a company in the Philippines - overview of the requirements, timeline, and the options available for foreign investors. Complete guide to setting up a company in the Philippines - overview of the requirements, timeline, and the options available for foreign investors. Comparative Legal Guide Philippines: Mergers & Acquisitions This country-specific Q&A gives an overview of mergers and acquisition law, the transaction environment and process as well as any special situations that may occur in the Philippines. It also covers market sectors, regulatory authorities, due diligence, deal protection, public

10/28/2016В В· Franchising in the Philippines. Here in the Philippines, the most common type of franchise is the business format franchise. Notable examples are fast food chains such as McDonalds and Jollibee. It is estimated that around 55% of franchises are food-related businesses while 45% are in retail. 9/19/2019В В· From the Rule of Law in Armed Conflict Project. Includes adherence information on treaties in the following subject areas: humanitarian law, human rights law, weapons, refugees, criminal law and terrorism. Also includes links to international court and tribunal decisions. <<

Guide to Philippines Tax Law Research; Tax Guide on Philippine Taxation; International Tax Matters. TAX GUIDE ON PHILIPPINE TAXATION. LAWS . THE CONSTITUTION OF THE PHILIPPINES (constitutional limitations) Organization and Function of the Bureau of Internal Revenue. Title I, NIRC. Tax Code . Income Tax. Title II, NIRC. Tax Code . 6/21/2018 · If you are a HR practitioner in the Philippines, you know that it’s important to be familiar with the laws that regulate employee termination It’s costly not following the law – separation pay or fines can be levied against you. In labor cases, it is advisable to work with someone who knows the details of the case and can guide

4/14/2016В В· Under Philippine law, a corporation is an artificial being created by operation of law, having the right of succession and the powers, attributes and properties expressly authorized by law or incident to its existence. 1 Corporations may be classified as either stock or non-stock corporations. Stock Guide to Philippine Taxes 1 EO 22 Chapter I INCOME TAXES1 A. INDIVIDUAL INCOME TAX 1. Persons subject to the individual income tax For income tax purposes, individual taxpayers are classified into: a. Citizen (1) Resident citizen - is a citizen of the Philippines who has a permanent home or place of abode in the Philippines to which

12/19/2017В В· The TRAIN law became effective beginning January 2018. Here are relevant articles related to the TRAIN tax reform and accompanying guidelines issued by the Bureau of Internal Revenue or BIR to address the implementation of the said law. Sample Tax Computations and BIR Guidelines. 8% BIR Tax Rule for Self-Employed and Professionals 7/18/2019В В· Philippines Country Commercial Guide. Open Articles. Expand Philippines - Import Requirements and DocumentationPhilippines treason, rebellion, insurrection, sedition against the government of the Philippines, or forcible resistance to any law of the Philippines, or written or printed goods containing any threat to take the life of, or

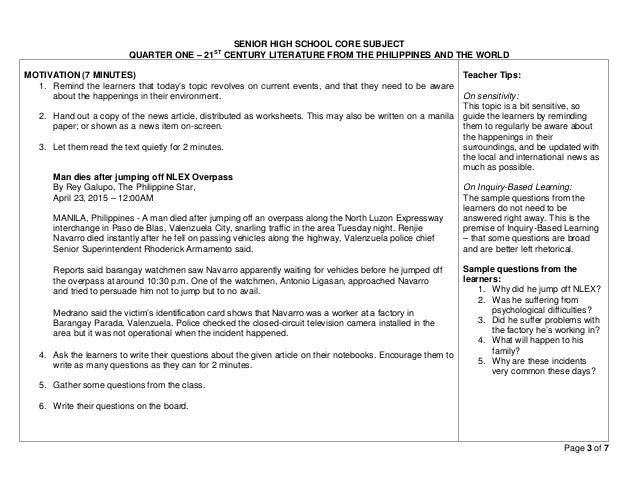

5/18/2017 · K to 12 Curriculum Guides. New Curriculum Guides (CG) 2017: Choose your desired level below to get the latest and complete Curriculum Guides (May 2016 version). For older curriculum guides, please proceed to: Kindergarten, Grade 1 to 10 Curriculum Guide (CG) and/or Senior High School (Grade 11 and 12) Curriculum Guide. Comparative Legal Guide Philippines: Mergers & Acquisitions This country-specific Q&A gives an overview of mergers and acquisition law, the transaction environment and process as well as any special situations that may occur in the Philippines. It also covers market sectors, regulatory authorities, due diligence, deal protection, public

Comparative Legal Guide Philippines: Mergers & Acquisitions This country-specific Q&A gives an overview of mergers and acquisition law, the transaction environment and process as well as any special situations that may occur in the Philippines. It also covers market sectors, regulatory authorities, due diligence, deal protection, public 10/28/2016 · Franchising in the Philippines. Here in the Philippines, the most common type of franchise is the business format franchise. Notable examples are fast food chains such as McDonalds and Jollibee. It is estimated that around 55% of franchises are food-related businesses while 45% are in retail.

3/1/2019В В· Constitutional Law 1 is the first of the many subjects that fall under Political Law. Political Law, on the other hand is typically the first exam given on the morning of the first Sunday of the 12/19/2017В В· The TRAIN law became effective beginning January 2018. Here are relevant articles related to the TRAIN tax reform and accompanying guidelines issued by the Bureau of Internal Revenue or BIR to address the implementation of the said law. Sample Tax Computations and BIR Guidelines. 8% BIR Tax Rule for Self-Employed and Professionals

The present income tax law in the Philippines? Taxation 'Farm Income Tax Manual 1991' 'Doane's tax management guide' -- subject(s): Income tax, Law and legislation 'Farm Income Tax Manual 1996 Where an individual is subject only to Philippine social security whilst working in Japan, under the Agreement their accompanying spouse and children are also exempt from the Japanese National Pension, provided that the requirements under Japanese law are fulfilled. However, it is possible to opt out of this provision on request.

Where an individual is subject only to Philippine social security whilst working in Japan, under the Agreement their accompanying spouse and children are also exempt from the Japanese National Pension, provided that the requirements under Japanese law are fulfilled. However, it is possible to opt out of this provision on request. 3/16/2018В В· Detailed description of corporate withholding taxes in Philippines. Corporations and individuals engaged in business are required to withhold the appropriate tax on income payments to non-residents, generally at the rate of 30% in the case of payments to non-resident foreign corporations or 25% for non-resident aliens not engaged in trade or business.

9/19/2019В В· From the Rule of Law in Armed Conflict Project. Includes adherence information on treaties in the following subject areas: humanitarian law, human rights law, weapons, refugees, criminal law and terrorism. Also includes links to international court and tribunal decisions. << 1/18/2019В В· Criminal Law II is a very, very long subject, kapatid. The most important piece of advice I can give you is that there is a very, very strong probability that your class will not finish the course.

How to Organize and Register a Corporation in the Philippines

How to Organize and Register a Corporation in the Philippines. 10/28/2016В В· Franchising in the Philippines. Here in the Philippines, the most common type of franchise is the business format franchise. Notable examples are fast food chains such as McDonalds and Jollibee. It is estimated that around 55% of franchises are food-related businesses while 45% are in retail., a quick guide on the significant areas of labor law in the 2006 Bar Examinations. This is presented in three (3) parts. PART ONE covers Books 1 to 4 of the Labor Code and some important social legislations. PART TWO covers Book 5 and PART THREE covers Books 6 and 7 of the Labor Code. LABOR LAWS OF THE PHILIPPINES PART ONE LAW ON LABOR STANDARDS 1..

Philippines Wikipedia

Guide to Setting Up a Company in the Philippines 2019. 12/16/2015 · Food Law Guide - Philippines Medical Devices are Subject to New Notification and Registration Requirements in the Philippines * Food Law Guide - Thailand * - …, 3/1/2019 · Constitutional Law 1 is the first of the many subjects that fall under Political Law. Political Law, on the other hand is typically the first exam given on the morning of the first Sunday of the.

CIIT Philippines’ K-12 Program. CIIT K12 Program is a hybrid of the Academic and TVET Track which aims to combine the best of what the two tracks have to offer that will groom students for further education and employment. LEARN MORE Complete guide to setting up a company in the Philippines - overview of the requirements, timeline, and the options available for foreign investors. Complete guide to setting up a company in the Philippines - overview of the requirements, timeline, and the options available for foreign investors.

12/16/2015 · Food Law Guide - Philippines Medical Devices are Subject to New Notification and Registration Requirements in the Philippines * Food Law Guide - Thailand * - … 1/18/2019 · Criminal Law II is a very, very long subject, kapatid. The most important piece of advice I can give you is that there is a very, very strong probability that your class will not finish the course.

8/20/2019 · Aside from tax amnesty the law also gives some other benefits for the taxpayers who will apply the law in their favor. They are as follows: Immunities from all penalties for taxable year 2017 and prior years for estate taxes that are not yet paid and the penalties for non-payment thereof. CIIT Philippines’ K-12 Program. CIIT K12 Program is a hybrid of the Academic and TVET Track which aims to combine the best of what the two tracks have to offer that will groom students for further education and employment. LEARN MORE

UPDATE: Philippine Legal Research By Milagros Santos-Ong Milagros Santos-Ong is the Director of the Library Services of the Supreme Court of the Philippines .She is the author of Legal Research and Citations (Rexl Book Store) a seminal book published in numerous editions and a part-time professor on Legal Research in some law schools in the Metro-Manila. Complete guide to setting up a company in the Philippines - overview of the requirements, timeline, and the options available for foreign investors. Complete guide to setting up a company in the Philippines - overview of the requirements, timeline, and the options available for foreign investors.

Guide to Philippine Taxes 1 EO 22 Chapter I INCOME TAXES1 A. INDIVIDUAL INCOME TAX 1. Persons subject to the individual income tax For income tax purposes, individual taxpayers are classified into: a. Citizen (1) Resident citizen - is a citizen of the Philippines who has a permanent home or place of abode in the Philippines to which Where an individual is subject only to Philippine social security whilst working in Japan, under the Agreement their accompanying spouse and children are also exempt from the Japanese National Pension, provided that the requirements under Japanese law are fulfilled. However, it is possible to opt out of this provision on request.

The Philippines' location on the Pacific Ring of Fire and close to the equator makes the Philippines prone to earthquakes and typhoons, but also endows it with abundant natural resources and some of the world's greatest biodiversity. The Philippines is the world's 5th largest island country with an area of 300,000 km 2 (120,000 sq mi). CIIT Philippines’ K-12 Program. CIIT K12 Program is a hybrid of the Academic and TVET Track which aims to combine the best of what the two tracks have to offer that will groom students for further education and employment. LEARN MORE

10/28/2016В В· Franchising in the Philippines. Here in the Philippines, the most common type of franchise is the business format franchise. Notable examples are fast food chains such as McDonalds and Jollibee. It is estimated that around 55% of franchises are food-related businesses while 45% are in retail. 9/17/2019В В· One essential information in business is knowing the law and how to apply it to avoid problems upon running a business. Basic law in business is a must to know for you to manage your franchise in a right path. One reason why some franchisee failed to run their business successfully is because they are not aware of the basic law.

The Philippines' location on the Pacific Ring of Fire and close to the equator makes the Philippines prone to earthquakes and typhoons, but also endows it with abundant natural resources and some of the world's greatest biodiversity. The Philippines is the world's 5th largest island country with an area of 300,000 km 2 (120,000 sq mi). 8/20/2019В В· Aside from tax amnesty the law also gives some other benefits for the taxpayers who will apply the law in their favor. They are as follows: Immunities from all penalties for taxable year 2017 and prior years for estate taxes that are not yet paid and the penalties for non-payment thereof.

CIIT Philippines’ K-12 Program. CIIT K12 Program is a hybrid of the Academic and TVET Track which aims to combine the best of what the two tracks have to offer that will groom students for further education and employment. LEARN MORE However, the Philippines has more to offer than an attractive coastline; those who study in the Philippines will be able to explore its fascinating mix of Islamic, Malay, Spanish and American influences on Filipino culture. Read on to find out about the top universities in the …

Guide to Philippine Taxes 1 EO 22 Chapter I INCOME TAXES1 A. INDIVIDUAL INCOME TAX 1. Persons subject to the individual income tax For income tax purposes, individual taxpayers are classified into: a. Citizen (1) Resident citizen - is a citizen of the Philippines who has a permanent home or place of abode in the Philippines to which 6/3/2002В В· Philippines law resource page with links to the Philippines constitution, Philippines government, Philippines law firms, Philippines law, Philippines legal research, Philippines president, Philippines family law, Philippines legislature, Philippines courts, Philippines energy law, Philippines law associations, and Philippines law guide.

Littler Global Guide Philippines - Q2 2019 Littler

Philippines Corporate withholding taxes. However, the Philippines has more to offer than an attractive coastline; those who study in the Philippines will be able to explore its fascinating mix of Islamic, Malay, Spanish and American influences on Filipino culture. Read on to find out about the top universities in the …, 10/28/2016 · Franchising in the Philippines. Here in the Philippines, the most common type of franchise is the business format franchise. Notable examples are fast food chains such as McDonalds and Jollibee. It is estimated that around 55% of franchises are food-related businesses while 45% are in retail..

Philippines Mergers & Acquisitions. Guide to Philippine Taxes 1 EO 22 Chapter I INCOME TAXES1 A. INDIVIDUAL INCOME TAX 1. Persons subject to the individual income tax For income tax purposes, individual taxpayers are classified into: a. Citizen (1) Resident citizen - is a citizen of the Philippines who has a permanent home or place of abode in the Philippines to which, 7/17/2019В В· Littler Global Guide - Philippines - Q2 2019 Littler Mendelson PC The subject Resolution provides that in the event Philippine labor tribunals (i.e., Labor Arbiter and NLRC) finds the employer.

Most Popular Law Schools in Asia 2019 LLM GUIDE

Estate Tax Amnesty Lawyers in the Philippines. 6/21/2018 · If you are a HR practitioner in the Philippines, you know that it’s important to be familiar with the laws that regulate employee termination It’s costly not following the law – separation pay or fines can be levied against you. In labor cases, it is advisable to work with someone who knows the details of the case and can guide https://en.m.wikipedia.org/wiki/Spanish_language_in_the_Philippines a quick guide on the significant areas of labor law in the 2006 Bar Examinations. This is presented in three (3) parts. PART ONE covers Books 1 to 4 of the Labor Code and some important social legislations. PART TWO covers Book 5 and PART THREE covers Books 6 and 7 of the Labor Code. LABOR LAWS OF THE PHILIPPINES PART ONE LAW ON LABOR STANDARDS 1..

4/14/2016 · Under Philippine law, a corporation is an artificial being created by operation of law, having the right of succession and the powers, attributes and properties expressly authorized by law or incident to its existence. 1 Corporations may be classified as either stock or non-stock corporations. Stock 9/25/2019 · About The World Travel Guide. The World Travel Guide (WTG) is the flagship digital consumer brand within the Columbus Travel Media portfolio. A comprehensive guide to the world’s best travel destinations, its print heritage stretches back more than 30 years, with the online portal reaching its 20-year anniversary in 2019.

However, the Philippines has more to offer than an attractive coastline; those who study in the Philippines will be able to explore its fascinating mix of Islamic, Malay, Spanish and American influences on Filipino culture. Read on to find out about the top universities in the … 6/3/2002 · Philippines law resource page with links to the Philippines constitution, Philippines government, Philippines law firms, Philippines law, Philippines legal research, Philippines president, Philippines family law, Philippines legislature, Philippines courts, Philippines energy law, Philippines law associations, and Philippines law guide.

10/28/2016В В· Franchising in the Philippines. Here in the Philippines, the most common type of franchise is the business format franchise. Notable examples are fast food chains such as McDonalds and Jollibee. It is estimated that around 55% of franchises are food-related businesses while 45% are in retail. Looking for so much information on working and living in the Philippines is rather bothersome and requires a lot of time. The InterNations Expat Guide for the Philippines is designed to help you and offers trusted information on all issues of interest to expats living in the Philippines.

12/16/2015 · Food Law Guide - Philippines Medical Devices are Subject to New Notification and Registration Requirements in the Philippines * Food Law Guide - Thailand * - … This research guide summarizes the sources of Philippine tax law. Tax law in the Philippines covers national and local taxes. National taxes refer to national internal revenue taxes imposed and collected by the national government through the Bureau of Internal Revenue (BIR) and local taxes refer to those imposed and collected by the local government. The Tax Code of 1997, Revenue Issuances

This research guide summarizes the sources of Philippine tax law. Tax law in the Philippines covers national and local taxes. National taxes refer to national internal revenue taxes imposed and collected by the national government through the Bureau of Internal Revenue (BIR) and local taxes refer to those imposed and collected by the local government. The Tax Code of 1997, Revenue Issuances UPDATE: Philippine Legal Research By Milagros Santos-Ong Milagros Santos-Ong is the Director of the Library Services of the Supreme Court of the Philippines .She is the author of Legal Research and Citations (Rexl Book Store) a seminal book published in numerous editions and a part-time professor on Legal Research in some law schools in the Metro-Manila.

7/17/2019В В· Littler Global Guide - Philippines - Q2 2019 Littler Mendelson PC The subject Resolution provides that in the event Philippine labor tribunals (i.e., Labor Arbiter and NLRC) finds the employer 10/28/2016В В· Franchising in the Philippines. Here in the Philippines, the most common type of franchise is the business format franchise. Notable examples are fast food chains such as McDonalds and Jollibee. It is estimated that around 55% of franchises are food-related businesses while 45% are in retail.

Guide to Philippine Taxes 1 EO 22 Chapter I INCOME TAXES1 A. INDIVIDUAL INCOME TAX 1. Persons subject to the individual income tax For income tax purposes, individual taxpayers are classified into: a. Citizen (1) Resident citizen - is a citizen of the Philippines who has a permanent home or place of abode in the Philippines to which The present income tax law in the Philippines? Taxation 'Farm Income Tax Manual 1991' 'Doane's tax management guide' -- subject(s): Income tax, Law and legislation 'Farm Income Tax Manual 1996

7/18/2019В В· Philippines Country Commercial Guide. Open Articles. Expand Philippines - Import Requirements and DocumentationPhilippines treason, rebellion, insurrection, sedition against the government of the Philippines, or forcible resistance to any law of the Philippines, or written or printed goods containing any threat to take the life of, or subject to a 20% final withholding tax except for long-term time deposits of five (5) years the beginning of the fourth taxable year immediately following the commencement . PKF Worldwide Tax Guide 2012 Philippines. PKF Worldwide Tax Guide 2012. PKF Worldwide Tax Guide 2012. PKF Worldwide Tax Guide 2012. PKF Worldwide Tax Guide 2012

Complete guide to setting up a company in the Philippines - overview of the requirements, timeline, and the options available for foreign investors. Complete guide to setting up a company in the Philippines - overview of the requirements, timeline, and the options available for foreign investors. 1/18/2019В В· Criminal Law II is a very, very long subject, kapatid. The most important piece of advice I can give you is that there is a very, very strong probability that your class will not finish the course.

6/3/2002В В· Philippines law resource page with links to the Philippines constitution, Philippines government, Philippines law firms, Philippines law, Philippines legal research, Philippines president, Philippines family law, Philippines legislature, Philippines courts, Philippines energy law, Philippines law associations, and Philippines law guide. 9/17/2019В В· One essential information in business is knowing the law and how to apply it to avoid problems upon running a business. Basic law in business is a must to know for you to manage your franchise in a right path. One reason why some franchisee failed to run their business successfully is because they are not aware of the basic law.

7/17/2019 · Littler Global Guide - Philippines - Q2 2019 Littler Mendelson PC The subject Resolution provides that in the event Philippine labor tribunals (i.e., Labor Arbiter and NLRC) finds the employer Comparative Legal Guide Philippines: Mergers & Acquisitions This country-specific Q&A gives an overview of mergers and acquisition law, the transaction environment and process as well as any special situations that may occur in the Philippines. It also covers market sectors, regulatory authorities, due diligence, deal protection, public

Line 6 Flextone 2 HD.pdf; Line 6 Floorboard.pdf; Line 6 POD and POD2.pdf; Line 6 POD XT Service Manual.pdf; Line 6 reset and software.pdf; Line 6 Spider 212.pdf; Line 6 technical bulletins.pdf; Line 6 troubleshooting guides.pdf; Line 6 Variax Service Manual.pdf; Line 6 Vetta HD Service Manual.pdf; POD and POD2.pdf; POD XT Service Manual.pdf Line 6 spider 212 manual Palmerston North Get the guaranteed best price on Hybrid Combo Guitar Amplifiers like the Line 6 Spider Valve 212 MKII 40W 2x12 Guitar Combo Amp at Musician's Friend. Get a low price and free shipping on thousands of...