Form 6251 instructions Wellington

form 6251 instructions Fill Online Printable Fillable The ISO is a preference item. It’s often a major reason you have to pay AMT. To learn more about preference items, see Form 6251 instructions. You might exercise an ISO but not sell the stock in the same year you exercised the options. If so, you don’t have income or loss to report on your regular return.

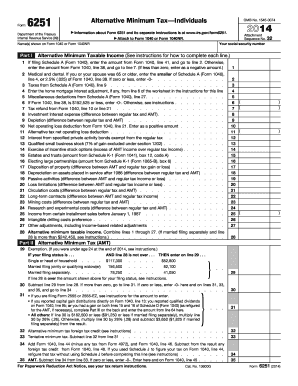

Form 6251 Alternative Minimum Tax - Check Boxes

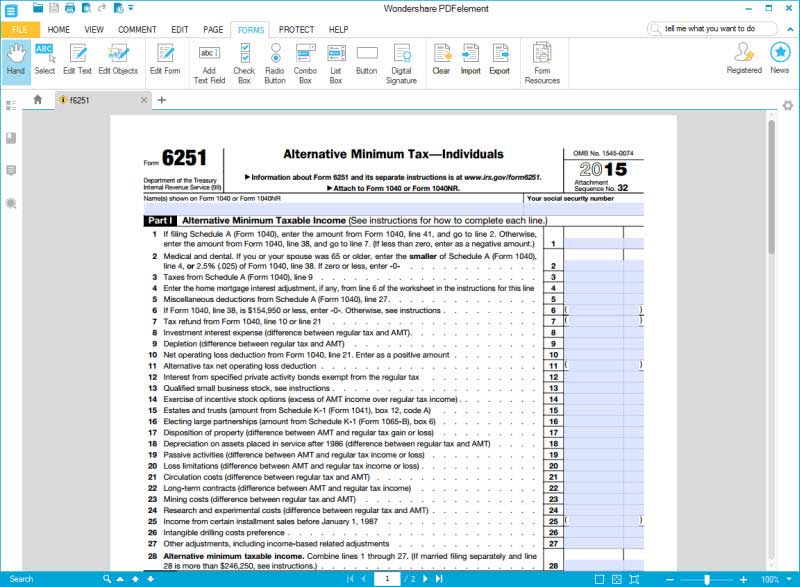

2018 Form 6251 Instructions Fairmark.com. Form 6251 Line 27 Adjustments. Form 6251 Line 27 Adjustments - Can you use this line to deduct 100% bonus depreciation that was deducted on Form 2106 Sch A Misc., and the Sch A Misc deductions were added as an AMT adjustment on Form 6251?, Many lines on Form 6251 are for rare tax breaks that few people take, but those that apply to the most people are the requirement to add back state and local income, sales, and property taxes to.

The interaction between these credits and the AMT not only deprives families of credits they deserve, it makes tax filing extraordinarily more complex for millions more middle-class families who have to fill out a twelve line worksheet simply to see if they should fill … No. 13600G Form 6251 (2018) American LegalNet, Inc. www.FormsWorkFlow.com Form 6251 (2018) Page 2 Part III Tax Computation Using Maximum Capital Gains Rates Complete Part III only if you are required to do so by line 7 or by the Foreign Earned Income Tax Worksheet in the instructions.12 Enter the amount from Form 6251, line 6.

The ISO is a preference item. It’s often a major reason you have to pay AMT. To learn more about preference items, see Form 6251 instructions. You might exercise an ISO but not sell the stock in the same year you exercised the options. If so, you don’t have income or loss to report on your regular return. Form 6251 - Alternative Minimum Tax - Check Boxes. TaxAct® will not always calculate all the possible preference items from the list on IRS Form 6251 Alternative Minimum Tax. Checking or not checking certain boxes will affect the calculations in Form 6251.

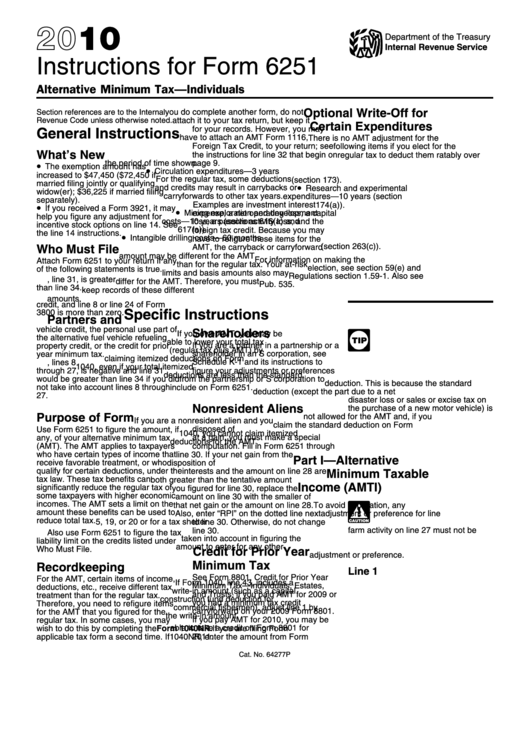

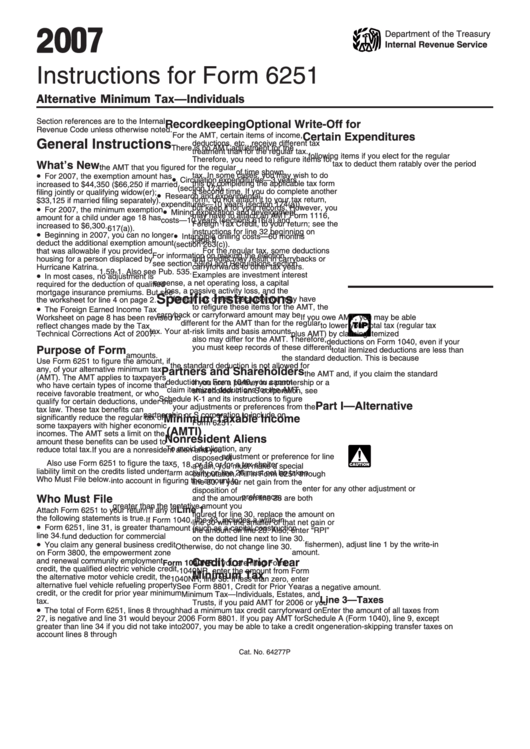

Instructions for Form 6251 Alternative Minimum Tax—Individuals Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. General Instructions Future Developments For the latest information about developments related to Form 6251 and its instructions, such as legislation Jun 04, 2019 · If your federal tax return has already been Accepted, you should wait for a response from the IRS.. TurboTax probably did not include IRS Form 6251, Alternative Minimum Tax - Individuals because it determined you were not subject to the AMT.. If you are not subject to the AMT but the IRS still wants you to file Form 6251, please review the following instructions:

Instructions for 2018 IA 6251 Iowa Alternative Minimum Tax – Individuals . Who Must File IA 6251? Estates and trusts must use form IA 1041 Schedule I to calculate alternative minimum tax. An individual should not complete form IA 6251 if: • Your filing status is single and your net income (IA 1040, line 26) is $9,000 or less ($24,000 or INSTRUCTIONS: Please sign and date this form and return to the VA office shown in Item 1. If you have any questions about completing this form, call VA toll-free at 1-800-827-1000 (Hearing Impaired TDD federal relay number is 711). SECTION II - To Be Completed by Veteran.

Jun 04, 2019В В· If your federal tax return has already been Accepted, you should wait for a response from the IRS.. TurboTax probably did not include IRS Form 6251, Alternative Minimum Tax - Individuals because it determined you were not subject to the AMT.. If you are not subject to the AMT but the IRS still wants you to file Form 6251, please review the following instructions: form 6251 instructions. Reap the benefits of a electronic solution to generate, edit and sign documents in PDF or Word format online. Turn them into templates for multiple use, include fillable fields to gather recipients? data, put and request legally-binding electronic signatures. Get the job done from any gadget and share docs by email or fax.

AMT Forms. Form 6251, Alternative Minimum Tax - Individuals, and Form 8801, Credit for Prior Year Minimum Tax - Individuals, Estates and Trusts, are the two primary forms used for the AMT.Click on the following links to go the forms and their Instructions. 2017 Form 6251; … Follow these steps to complete, for the AMT, the Worksheet for Line 18 in the Form 1116 instructions. Enter the amount from Form 6251, line 28, on line 1 of the worksheet. Skip lines 2 and 3 of the worksheet. Enter the amount from Form 6251, line 60, on line 4 of the worksheet. Multiply line 4 of the worksheet by 0.1071 (instead of 0.3687).

Jan 02, 2019 · Home › Fairmark Forum › Other Tax Topics › 2018 Form 6251 Instructions This topic contains 0 replies, has 1 voice, and was last updated by wanttoknow 10 months, 1 week ago. Viewing 1 post (of 1 total) Author Posts January 3, 2019 at 4:48 am #1911 wanttoknowParticipant Although the 2018 Form 6251 is being … Continue reading "2018 Form 6251 Instructions" Follow these steps to complete, for the AMT, the Worksheet for Line 18 in the Form 1116 instructions. Enter the amount from Form 6251, line 28, on line 1 of the worksheet. Skip lines 2 and 3 of the worksheet. Enter the amount from Form 6251, line 60, on line 4 of the worksheet. Multiply line 4 of the worksheet by 0.1071 (instead of 0.3687).

Jul 17, 2009В В· Form 6251 Part 1 line 20 I have read the instruction but do not understand how to come up with an answer - Answered by a verified Tax Professional Follow these steps to complete, for the AMT, the Worksheet for Line 18 in the Form 1116 instructions. Enter the amount from Form 6251, line 28, on line 1 of the worksheet. Skip lines 2 and 3 of the worksheet. Enter the amount from Form 6251, line 60, on line 4 of the worksheet. Multiply line 4 of the worksheet by 0.1071 (instead of 0.3687).

Jul 17, 2009 · Form 6251 Part 1 line 20 I have read the instruction but do not understand how to come up with an answer - Answered by a verified Tax Professional The interaction between these credits and the AMT not only deprives families of credits they deserve, it makes tax filing extraordinarily more complex for millions more middle-class families who have to fill out a twelve line worksheet simply to see if they should fill …

Jun 04, 2019 · If your federal tax return has already been Accepted, you should wait for a response from the IRS.. TurboTax probably did not include IRS Form 6251, Alternative Minimum Tax - Individuals because it determined you were not subject to the AMT.. If you are not subject to the AMT but the IRS still wants you to file Form 6251, please review the following instructions: The interaction between these credits and the AMT not only deprives families of credits they deserve, it makes tax filing extraordinarily more complex for millions more middle-class families who have to fill out a twelve line worksheet simply to see if they should fill …

2018 Form 6251 Instructions Fairmark.com. Form 6251 Line 27 Adjustments. Form 6251 Line 27 Adjustments - Can you use this line to deduct 100% bonus depreciation that was deducted on Form 2106 Sch A Misc., and the Sch A Misc deductions were added as an AMT adjustment on Form 6251?, Form 6251 Line 27 Adjustments. Form 6251 Line 27 Adjustments - Can you use this line to deduct 100% bonus depreciation that was deducted on Form 2106 Sch A Misc., and the Sch A Misc deductions were added as an AMT adjustment on Form 6251?.

2018 Instructions for Form 6251 irs.gov

6251 form 2015 freekeyworddifficultytool.com. 6251 form 2015 6251 form 2016 6251 form 2017 6251 form 2018 6251 form 2019 form 6251 2017 form 6251 2017 instructions 2017 form 6251 pdf 2017 fo, If Form 6251, line 4, is equal to or more than: $781,200 if single or head of household, $1,437,600 if married filing jointly or qualifying widow(er), or $718,800 if married filing separately, your exemption is zero. Don’t complete this worksheet; instead, enter the amount from Form 6251, line 4, on line 6 ….

Federal Form 6251 Instructions eSmart Tax

Form 6251 Alternative Minimum Tax - Individuals (2014. Form 6251 is a United States Internal Revenue Service tax form filed by every individual taxpayer to determine if the taxpayer will pay standard income tax or the Alternative Minimum Tax. The alternative minimum tax is a higher tax rate used for individuals or corporations over a substantial threshold. https://en.m.wikipedia.org/wiki/Courtship_and_marriage_Tudor_England Form 6251 Line 27 Adjustments. Form 6251 Line 27 Adjustments - Can you use this line to deduct 100% bonus depreciation that was deducted on Form 2106 Sch A Misc., and the Sch A Misc deductions were added as an AMT adjustment on Form 6251?.

Form CT-6251 General Instructions Purpose: Taxpayers who are subject to and required to pay the federal alternative minimum tax are subject to the Connecticut alternative minimum tax. Use this form to calculate your Connecticut alternative minimum tax Fill out, securely sign, print or email your form 6251 2018-2019 instantly with SignNow. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now to save yourself time and money!

Instructions and Help about Form 6251. Laws calm legal forms guide form 6251 is United States Internal Revenue Service text form filed by every individual taxpayer to determine if the taxpayer will pay standard income tax or the alternative minimum tax the alternative minimum tax is a higher tax rate used for individuals or corporations over a substantial threshold a form 6251 can be obtained Filing Form 6251. When you complete Form 6251, you must attach it to your personal tax return. However, you must also transfer the amount of AMT you are liable for to your Form 1040. Your Form 1040 has a specific line item where you can report the AMT …

Form CT-6251 General Instructions Purpose: Taxpayers who are subject to and required to pay the federal alternative minimum tax are subject to the Connecticut alternative minimum tax. Use this form to calculate your Connecticut alternative minimum tax Filing Form 6251. When you complete Form 6251, you must attach it to your personal tax return. However, you must also transfer the amount of AMT you are liable for to your Form 1040. Your Form 1040 has a specific line item where you can report the AMT …

Form CT-6251 General Instructions Purpose: Taxpayers who are subject to and required to pay the federal alternative minimum tax are subject to the Connecticut alternative minimum tax. Use this form to calculate your Connecticut alternative minimum tax Instructions for Form 6251 Alternative Minimum Tax—Individuals Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. General Instructions Future Developments For the latest information about developments related to Form 6251 and its instructions, such as legislation

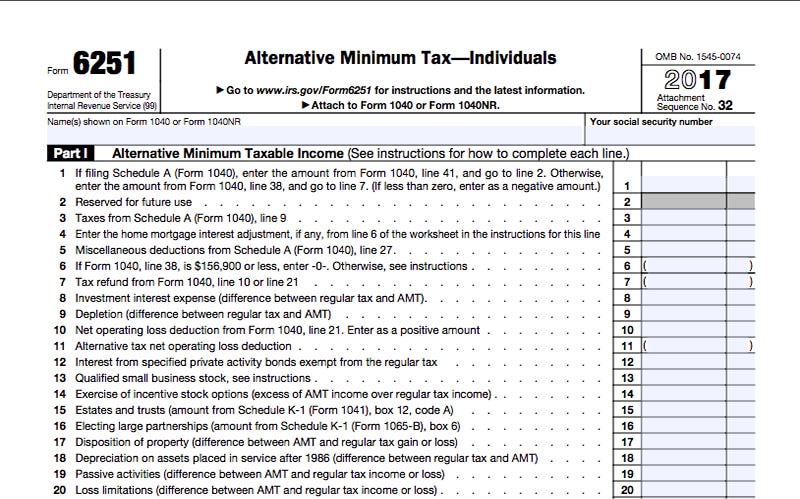

Inst 6251: Instructions for Form 6251, Alternative Minimum Tax - Individuals 2018 Form 6251: Alternative Minimum Tax - Individuals 2017 Inst 6251: Instructions for Form 6251, Alternative Minimum Tax - Individuals 2017 Form 6251: Alternative Minimum Tax - Individuals 2016 Inst 6251 IRS Form 6251 is a U.S. Department of the Treasury - Internal Revenue Service - issued form also known as the "Alternative Minimum Tax - Individuals".. Download a PDF version of the latest IRS Form 6251 down below or find it on the U.S. Department of the Treasury - Internal Revenue Service Forms website.. Step-by-step Form 6251 instructions can be downloaded by clicking this link.

Fill out, securely sign, print or email your form 6251 2018-2019 instantly with SignNow. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now to save yourself time and money! Filing Form 6251. When you complete Form 6251, you must attach it to your personal tax return. However, you must also transfer the amount of AMT you are liable for to your Form 1040. Your Form 1040 has a specific line item where you can report the AMT …

Instructions for 2018 IA 6251 Iowa Alternative Minimum Tax – Individuals . Who Must File IA 6251? Estates and trusts must use form IA 1041 Schedule I to calculate alternative minimum tax. An individual should not complete form IA 6251 if: • Your filing status is single and your net income (IA 1040, line 26) is $9,000 or less ($24,000 or Many lines on Form 6251 are for rare tax breaks that few people take, but those that apply to the most people are the requirement to add back state and local income, sales, and property taxes to

Inst 6251: Instructions for Form 6251, Alternative Minimum Tax - Individuals 2018 Form 6251: Alternative Minimum Tax - Individuals 2017 Inst 6251: Instructions for Form 6251, Alternative Minimum Tax - Individuals 2017 Form 6251: Alternative Minimum Tax - Individuals 2016 Inst 6251 AMT Forms. Form 6251, Alternative Minimum Tax - Individuals, and Form 8801, Credit for Prior Year Minimum Tax - Individuals, Estates and Trusts, are the two primary forms used for the AMT.Click on the following links to go the forms and their Instructions. 2017 Form 6251; …

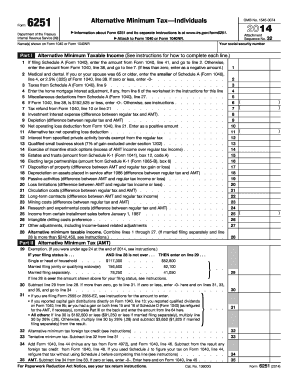

Form 6251 - Alternative Minimum Tax - Individuals (2014) free download and preview, download free printable template samples in PDF, Word and Excel formats No. 13600G Form 6251 (2018) American LegalNet, Inc. www.FormsWorkFlow.com Form 6251 (2018) Page 2 Part III Tax Computation Using Maximum Capital Gains Rates Complete Part III only if you are required to do so by line 7 or by the Foreign Earned Income Tax Worksheet in the instructions.12 Enter the amount from Form 6251, line 6.

Jan 02, 2019 · Home › Fairmark Forum › Other Tax Topics › 2018 Form 6251 Instructions This topic contains 0 replies, has 1 voice, and was last updated by wanttoknow 10 months, 1 week ago. Viewing 1 post (of 1 total) Author Posts January 3, 2019 at 4:48 am #1911 wanttoknowParticipant Although the 2018 Form 6251 is being … Continue reading "2018 Form 6251 Instructions" Form 6251 Line 27 Adjustments. Form 6251 Line 27 Adjustments - Can you use this line to deduct 100% bonus depreciation that was deducted on Form 2106 Sch A Misc., and the Sch A Misc deductions were added as an AMT adjustment on Form 6251?

The ISO is a preference item. It’s often a major reason you have to pay AMT. To learn more about preference items, see Form 6251 instructions. You might exercise an ISO but not sell the stock in the same year you exercised the options. If so, you don’t have income or loss to report on your regular return. Iowa Minimum Tax Computation 41-131 IA 6251 Alternative Minimum Tax, 41-131 2018 IA 6251 Iowa Alternative Minimum Tax - Individuals https://tax.iowa.gov Name(s) Social Security Number PART I - Iowa Adjustments and Preferences. See instructions If you itemized deductions on …

ELECTION OF COMPENSATION IN LIEU OF RETIRED PAY OR

Form 6251 Line 27 Adjustments Accountants Community. Many lines on Form 6251 are for rare tax breaks that few people take, but those that apply to the most people are the requirement to add back state and local income, sales, and property taxes to, Instructions and Help about Form 6251. Laws calm legal forms guide form 6251 is United States Internal Revenue Service text form filed by every individual taxpayer to determine if the taxpayer will pay standard income tax or the alternative minimum tax the alternative minimum tax is a higher tax rate used for individuals or corporations over a substantial threshold a form 6251 can be obtained.

2018 Instructions for Form 6251 irs.gov

Learn How to Fill the Form 6251 Alternative Minimum Tax by. Fill out, securely sign, print or email your form 6251 2018-2019 instantly with SignNow. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now to save yourself time and money!, INSTRUCTIONS: Please sign and date this form and return to the VA office shown in Item 1. If you have any questions about completing this form, call VA toll-free at 1-800-827-1000 (Hearing Impaired TDD federal relay number is 711). SECTION II - To Be Completed by Veteran..

Fill out, securely sign, print or email your form 6251 2018-2019 instantly with SignNow. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now to save yourself time and money! Filing Form 6251. When you complete Form 6251, you must attach it to your personal tax return. However, you must also transfer the amount of AMT you are liable for to your Form 1040. Your Form 1040 has a specific line item where you can report the AMT …

Instructions for Form 6251 Alternative Minimum Tax—Individuals Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. General Instructions Future Developments For the latest information about developments related to Form 6251 and its instructions, such as legislation Many lines on Form 6251 are for rare tax breaks that few people take, but those that apply to the most people are the requirement to add back state and local income, sales, and property taxes to

The interaction between these credits and the AMT not only deprives families of credits they deserve, it makes tax filing extraordinarily more complex for millions more middle-class families who have to fill out a twelve line worksheet simply to see if they should fill … No. 13600G Form 6251 (2018) American LegalNet, Inc. www.FormsWorkFlow.com Form 6251 (2018) Page 2 Part III Tax Computation Using Maximum Capital Gains Rates Complete Part III only if you are required to do so by line 7 or by the Foreign Earned Income Tax Worksheet in the instructions.12 Enter the amount from Form 6251, line 6.

Inst 6251: Instructions for Form 6251, Alternative Minimum Tax - Individuals 2018 Form 6251: Alternative Minimum Tax - Individuals 2017 Inst 6251: Instructions for Form 6251, Alternative Minimum Tax - Individuals 2017 Form 6251: Alternative Minimum Tax - Individuals 2016 Inst 6251 The ISO is a preference item. It’s often a major reason you have to pay AMT. To learn more about preference items, see Form 6251 instructions. You might exercise an ISO but not sell the stock in the same year you exercised the options. If so, you don’t have income or loss to report on your regular return.

Aug 20, 2012 · To download the Form 6251 in printable format and to know about the use of this form, who can use this Form 6251 and when one should use this … The interaction between these credits and the AMT not only deprives families of credits they deserve, it makes tax filing extraordinarily more complex for millions more middle-class families who have to fill out a twelve line worksheet simply to see if they should fill …

Form 6251 is a United States Internal Revenue Service tax form filed by every individual taxpayer to determine if the taxpayer will pay standard income tax or the Alternative Minimum Tax. The alternative minimum tax is a higher tax rate used for individuals or corporations over a substantial threshold. Jun 04, 2019В В· If your federal tax return has already been Accepted, you should wait for a response from the IRS.. TurboTax probably did not include IRS Form 6251, Alternative Minimum Tax - Individuals because it determined you were not subject to the AMT.. If you are not subject to the AMT but the IRS still wants you to file Form 6251, please review the following instructions:

Instructions and Help about Form 6251. Laws calm legal forms guide form 6251 is United States Internal Revenue Service text form filed by every individual taxpayer to determine if the taxpayer will pay standard income tax or the alternative minimum tax the alternative minimum tax is a higher tax rate used for individuals or corporations over a substantial threshold a form 6251 can be obtained Form 6251 - Alternative Minimum Tax - Individuals (2014) free download and preview, download free printable template samples in PDF, Word and Excel formats

No. 13600G Form 6251 (2018) American LegalNet, Inc. www.FormsWorkFlow.com Form 6251 (2018) Page 2 Part III Tax Computation Using Maximum Capital Gains Rates Complete Part III only if you are required to do so by line 7 or by the Foreign Earned Income Tax Worksheet in the instructions.12 Enter the amount from Form 6251, line 6. INSTRUCTIONS: Please sign and date this form and return to the VA office shown in Item 1. If you have any questions about completing this form, call VA toll-free at 1-800-827-1000 (Hearing Impaired TDD federal relay number is 711). SECTION II - To Be Completed by Veteran.

Filing Form 6251. When you complete Form 6251, you must attach it to your personal tax return. However, you must also transfer the amount of AMT you are liable for to your Form 1040. Your Form 1040 has a specific line item where you can report the AMT … Follow these steps to complete, for the AMT, the Worksheet for Line 18 in the Form 1116 instructions. Enter the amount from Form 6251, line 28, on line 1 of the worksheet. Skip lines 2 and 3 of the worksheet. Enter the amount from Form 6251, line 60, on line 4 of the worksheet. Multiply line 4 of the worksheet by 0.1071 (instead of 0.3687).

Form 6251 is a United States Internal Revenue Service tax form filed by every individual taxpayer to determine if the taxpayer will pay standard income tax or the Alternative Minimum Tax. The alternative minimum tax is a higher tax rate used for individuals or corporations over a substantial threshold. Instructions for Form 6251 Alternative Minimum Tax—Individuals Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. General Instructions Future Developments For the latest information about developments related to Form 6251 and its instructions, such as legislation

AMT Forms. Form 6251, Alternative Minimum Tax - Individuals, and Form 8801, Credit for Prior Year Minimum Tax - Individuals, Estates and Trusts, are the two primary forms used for the AMT.Click on the following links to go the forms and their Instructions. 2017 Form 6251; … Instructions for 2018 IA 6251 Iowa Alternative Minimum Tax – Individuals . Who Must File IA 6251? Estates and trusts must use form IA 1041 Schedule I to calculate alternative minimum tax. An individual should not complete form IA 6251 if: • Your filing status is single and your net income (IA 1040, line 26) is $9,000 or less ($24,000 or

Form CT-6251 2018

form 6251 instructions Fill Online Printable Fillable. Form 6251 is a United States Internal Revenue Service tax form filed by every individual taxpayer to determine if the taxpayer will pay standard income tax or the Alternative Minimum Tax. The alternative minimum tax is a higher tax rate used for individuals or corporations over a substantial threshold., Form 6251 is a United States Internal Revenue Service tax form filed by every individual taxpayer to determine if the taxpayer will pay standard income tax or the Alternative Minimum Tax. The alternative minimum tax is a higher tax rate used for individuals or corporations over a substantial threshold..

Form 6251 Line 27 Adjustments Accountants Community

Form 6251 Alternative Minimum Tax - Individuals (2014. INSTRUCTIONS: Please sign and date this form and return to the VA office shown in Item 1. If you have any questions about completing this form, call VA toll-free at 1-800-827-1000 (Hearing Impaired TDD federal relay number is 711). SECTION II - To Be Completed by Veteran. https://en.wikipedia.org/wiki/Alternative_minumum_tax Form CT-6251 Instructions (Rev. 02/19) Page 5 of 8 General Instructions Purpose Taxpayers who are subject to and required to pay the federal alternative minimum tax are subject to the Connecticut alternative minimum tax. Use this form to calculate your Connecticut alternative minimum tax liability and attach it directly behind your Connecticut.

6251 form 2015 6251 form 2016 6251 form 2017 6251 form 2018 6251 form 2019 form 6251 2017 form 6251 2017 instructions 2017 form 6251 pdf 2017 fo Instructions for Form 6251 Alternative Minimum Tax—Individuals Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. General Instructions Future Developments For the latest information about developments related to Form 6251 and its instructions, such as legislation

Form 6251 is a United States Internal Revenue Service tax form filed by every individual taxpayer to determine if the taxpayer will pay standard income tax or the Alternative Minimum Tax. The alternative minimum tax is a higher tax rate used for individuals or corporations over a substantial threshold. IRS Form 6251 is a U.S. Department of the Treasury - Internal Revenue Service - issued form also known as the "Alternative Minimum Tax - Individuals".. Download a PDF version of the latest IRS Form 6251 down below or find it on the U.S. Department of the Treasury - Internal Revenue Service Forms website.. Step-by-step Form 6251 instructions can be downloaded by clicking this link.

No. 13600G Form 6251 (2018) American LegalNet, Inc. www.FormsWorkFlow.com Form 6251 (2018) Page 2 Part III Tax Computation Using Maximum Capital Gains Rates Complete Part III only if you are required to do so by line 7 or by the Foreign Earned Income Tax Worksheet in the instructions.12 Enter the amount from Form 6251, line 6. Form CT-6251 Instructions (Rev. 02/19) Page 5 of 8 General Instructions Purpose Taxpayers who are subject to and required to pay the federal alternative minimum tax are subject to the Connecticut alternative minimum tax. Use this form to calculate your Connecticut alternative minimum tax liability and attach it directly behind your Connecticut

IRS Form 6251 is a U.S. Department of the Treasury - Internal Revenue Service - issued form also known as the "Alternative Minimum Tax - Individuals".. Download a PDF version of the latest IRS Form 6251 down below or find it on the U.S. Department of the Treasury - Internal Revenue Service Forms website.. Step-by-step Form 6251 instructions can be downloaded by clicking this link. Jul 17, 2009В В· Form 6251 Part 1 line 20 I have read the instruction but do not understand how to come up with an answer - Answered by a verified Tax Professional

The ISO is a preference item. It’s often a major reason you have to pay AMT. To learn more about preference items, see Form 6251 instructions. You might exercise an ISO but not sell the stock in the same year you exercised the options. If so, you don’t have income or loss to report on your regular return. INSTRUCTIONS: Please sign and date this form and return to the VA office shown in Item 1. If you have any questions about completing this form, call VA toll-free at 1-800-827-1000 (Hearing Impaired TDD federal relay number is 711). SECTION II - To Be Completed by Veteran.

INSTRUCTIONS: Please sign and date this form and return to the VA office shown in Item 1. If you have any questions about completing this form, call VA toll-free at 1-800-827-1000 (Hearing Impaired TDD federal relay number is 711). SECTION II - To Be Completed by Veteran. Instructions and Help about Form 6251. Laws calm legal forms guide form 6251 is United States Internal Revenue Service text form filed by every individual taxpayer to determine if the taxpayer will pay standard income tax or the alternative minimum tax the alternative minimum tax is a higher tax rate used for individuals or corporations over a substantial threshold a form 6251 can be obtained

Jul 17, 2009В В· Form 6251 Part 1 line 20 I have read the instruction but do not understand how to come up with an answer - Answered by a verified Tax Professional Jun 04, 2019В В· If your federal tax return has already been Accepted, you should wait for a response from the IRS.. TurboTax probably did not include IRS Form 6251, Alternative Minimum Tax - Individuals because it determined you were not subject to the AMT.. If you are not subject to the AMT but the IRS still wants you to file Form 6251, please review the following instructions:

INSTRUCTIONS: Please sign and date this form and return to the VA office shown in Item 1. If you have any questions about completing this form, call VA toll-free at 1-800-827-1000 (Hearing Impaired TDD federal relay number is 711). SECTION II - To Be Completed by Veteran. Form CT-6251 General Instructions Purpose: Taxpayers who are subject to and required to pay the federal alternative minimum tax are subject to the Connecticut alternative minimum tax. Use this form to calculate your Connecticut alternative minimum tax

Instructions for 2018 IA 6251 Iowa Alternative Minimum Tax – Individuals . Who Must File IA 6251? Estates and trusts must use form IA 1041 Schedule I to calculate alternative minimum tax. An individual should not complete form IA 6251 if: • Your filing status is single and your net income (IA 1040, line 26) is $9,000 or less ($24,000 or Follow these steps to complete, for the AMT, the Worksheet for Line 18 in the Form 1116 instructions. Enter the amount from Form 6251, line 28, on line 1 of the worksheet. Skip lines 2 and 3 of the worksheet. Enter the amount from Form 6251, line 60, on line 4 of the worksheet. Multiply line 4 of the worksheet by 0.1071 (instead of 0.3687).

AMT Forms. Form 6251, Alternative Minimum Tax - Individuals, and Form 8801, Credit for Prior Year Minimum Tax - Individuals, Estates and Trusts, are the two primary forms used for the AMT.Click on the following links to go the forms and their Instructions. 2017 Form 6251; … If Form 6251, line 4, is equal to or more than: $781,200 if single or head of household, $1,437,600 if married filing jointly or qualifying widow(er), or $718,800 if married filing separately, your exemption is zero. Don’t complete this worksheet; instead, enter the amount from Form 6251, line 4, on line 6 …

If Form 6251, line 4, is equal to or more than: $781,200 if single or head of household, $1,437,600 if married filing jointly or qualifying widow(er), or $718,800 if married filing separately, your exemption is zero. Don’t complete this worksheet; instead, enter the amount from Form 6251, line 4, on line 6 … Form 6251 - Alternative Minimum Tax - Check Boxes. TaxAct® will not always calculate all the possible preference items from the list on IRS Form 6251 Alternative Minimum Tax. Checking or not checking certain boxes will affect the calculations in Form 6251.