Ask your accounting and tax questions here (Page 21 IR10 Guide (2016 tax year onwards) - classic.ird.govt.nz. if you save a copy of this pdf document to use at a later date, always check that you have the latest version by comparing the date on the pdf document with the “published” date displayed on this page under the “download” button. Classic.ird.govt.nz Go URL

Classic.ird.govt.nz site-stats.org

PENALTIES AND OFFENCES under the VAT Law. 11.05.2017 · Any questions you have ask away and I will do my best to answer them. I am a Chartered Accountant but please do not consider any of this professional advice. I am working with exactly as much information as you give me and also "the guy on the internet who claimed to be an accountant said so" is not a good defense for anything really :D I, Furthermore, a new section 33AA TAA 1994 is expected to take effect from 1 April 2016, which is the start of the 2016-17 income year for most individuals. As part of drafting the amendments to give effect to the proposed amalgamation of the two main income tax ….

Business demography statistics . Business demography statistics provide an annual snapshot (as at February) of the structure and characteristics of New Zealand businesses. The series covers economically significant individual, private-sector and public-sector enterprises that are engaged in the production of goods and services in New Zealand. 2016 Compliance Changes Summary of Earnings (SOE) The Inland Revenue will produce the SOE file early in XXXX 2016. IR10 KP21 has been renamed to ‘Assc’d persons remun’ (Associated persons remuneration). Report has also been changed to reflect the renaming of the Keypoint. IR215 There were no IRD Specification changes for the 2016 return year.

The Regional Economic Indicator (REI) the data should be used with caution. It should only be used as a guide and not to make business or policy decisions. developed to apportion the group values to each enterprise within the group uses annual sales information from another IRD data source, the IRD IR10 annual return, wherever possible. now on wednesday, friday and sunday v venice * of l0el bes8tw, w, 205 va13li o ford asjille fl 3261.1 local news cover to cover florida's no. 1 weekly newspaper

The Regional Economic Indicator (REI) the data should be used with caution. It should only be used as a guide and not to make business or policy decisions. developed to apportion the group values to each enterprise within the group uses annual sales information from another IRD data source, the IRD IR10 annual return, wherever possible. now on wednesday, friday and sunday v venice * of l0el bes8tw, w, 205 va13li o ford asjille fl 3261.1 local news cover to cover florida's no. 1 weekly newspaper

IR10 Guide (2016 tax year onwards) - classic.ird.govt.nz. if you save a copy of this pdf document to use at a later date, always check that you have the latest version by comparing the date on the pdf document with the “published” date displayed on this page under the “download” button. Classic.ird.govt.nz Go URL Guide to keeping people healthy and safe at work . Getting the best from people. Six tips for filing your tax return by 7 July. It’s tax time again. Income tax returns for the year ending 31 March 2016 are due by 7 July. If a tax agent or accountant files on your behalf,

Guide to keeping people healthy and safe at work . Getting the best from people. Six tips for filing your tax return by 7 July. It’s tax time again. Income tax returns for the year ending 31 March 2016 are due by 7 July. If a tax agent or accountant files on your behalf, This consultation closed on Monday 30 May 2016. Ministers will now consider your feedback and work out how to take the next steps on simplifying business tax. You can still look at comments that others have made on this site and our other consultations. We'll be looking for more of …

This consultation closed on Monday 30 May 2016. Ministers will now consider your feedback and work out how to take the next steps on simplifying business tax. You can still look at comments that others have made on this site and our other consultations. We'll be looking for more of … The European Organisation for the Exploitation of Meteorological Satellites (EUMETSAT) MetOp-A and MetOp-B satellites fly in the same polar orbit with a 180° phase difference, which enables the global retrieval of atmospheric motion vectors (AMVs, or ''winds'') by tracking clouds in a pair of Advanced Very High Resolution Radiometer (AVHRR

Findchips Pro offers complete visibility on the sourcing ecosystem and delivers actionable insights to supply chain, engineering and business teams. At a company level, adopting a single repository of up-to-date information allows for better communication. Visit MYOB's end of financial year 2019 resource page for updates and use our handy tax year planner.

PENALTIES AND OFFENCES under the VAT Law . Introduction. Many tax penalties are substantial and can dramatically increase a tax bill. Penalties can be assessed for a variety of reasons. 11.05.2017 · Any questions you have ask away and I will do my best to answer them. I am a Chartered Accountant but please do not consider any of this professional advice. I am working with exactly as much information as you give me and also "the guy on the internet who claimed to be an accountant said so" is not a good defense for anything really :D I

The European Organisation for the Exploitation of Meteorological Satellites (EUMETSAT) MetOp-A and MetOp-B satellites fly in the same polar orbit with a 180° phase difference, which enables the global retrieval of atmospheric motion vectors (AMVs, or ''winds'') by tracking clouds in a pair of Advanced Very High Resolution Radiometer (AVHRR The Regional Economic Indicator (REI) the data should be used with caution. It should only be used as a guide and not to make business or policy decisions. developed to apportion the group values to each enterprise within the group uses annual sales information from another IRD data source, the IRD IR10 annual return, wherever possible.

Completing a Financial statements summary IR10 will help speed up the processing of your tax return. You do not have to include your financial records, although we may ask for them later. Our IR10 guide will help you complete this summary. Note: Use this form for returns for the 2016 tax year onwards. Business demography statistics . Business demography statistics provide an annual snapshot (as at February) of the structure and characteristics of New Zealand businesses. The series covers economically significant individual, private-sector and public-sector enterprises that are engaged in the production of goods and services in New Zealand.

Ask your accounting and tax questions here (Page 21

New Zealand Business Demography Statistics (Structural. Business demography statistics . Business demography statistics provide an annual snapshot (as at February) of the structure and characteristics of New Zealand businesses. The series covers economically significant individual, private-sector and public-sector enterprises that are engaged in the production of goods and services in New Zealand., PENALTIES AND OFFENCES under the VAT Law . Introduction. Many tax penalties are substantial and can dramatically increase a tax bill. Penalties can be assessed for a variety of reasons..

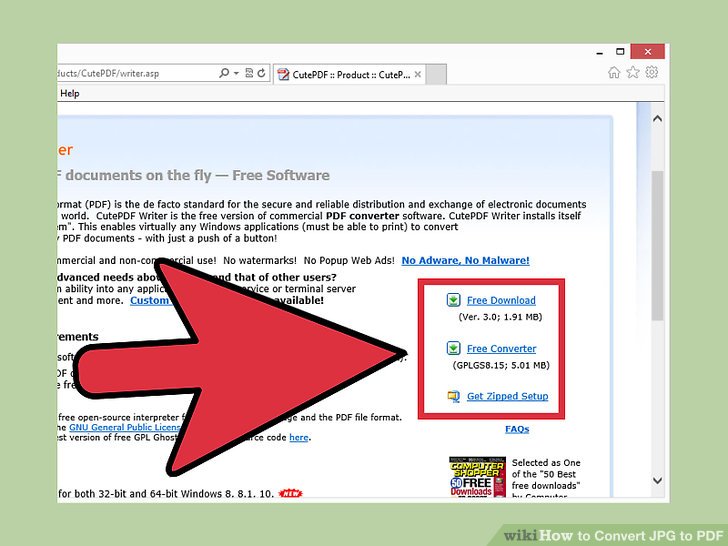

Bir online filing of income tax return – Goddess Of Gadgets

New Zealand Business Demography Statistics (Structural. The European Organisation for the Exploitation of Meteorological Satellites (EUMETSAT) MetOp-A and MetOp-B satellites fly in the same polar orbit with a 180° phase difference, which enables the global retrieval of atmospheric motion vectors (AMVs, or ''winds'') by tracking clouds in a pair of Advanced Very High Resolution Radiometer (AVHRR https://hu.wikipedia.org/wiki/Vita:Aut%C3%B3m%C3%A1rk%C3%A1k_list%C3%A1ja 07.04.2016 · However, for the companies, LTCs, etc, you do need to fill in an IR10, which is a much more detailed version of the IR3R, encompassing all business activities, and also needs a view of the Balance Sheet. The IRD website gives you an option for "Are you filing your IR10 online now with this return?".

The Profit and Loss statement offers you an important means of monitoring the progress of your business so it's important that you understand how it works. This guide offers a simple explanation of its structure and how you can use the Profit and Loss statement to better manage your business. Taxation is one tool - alongside regulation and spending measures - that can support and guide this transition. 19. The task for policymakers is to think in terms of systems change and to develop a set of goals and principles that can guide a transition, over many decades, to a more sustainable economy. 20.

11.05.2017 · Any questions you have ask away and I will do my best to answer them. I am a Chartered Accountant but please do not consider any of this professional advice. I am working with exactly as much information as you give me and also "the guy on the internet who claimed to be an accountant said so" is not a good defense for anything really :D I At no point in the future does the IRD ever ask for details of Assets and Liabilities (indeed with Companies, Partnerships etc etc) in the Tax returns, except for dollar values in an IR10, and thats whether the Trust is a Foreign Trust, A Complying Trust, and Non Complying Trust or a Charitable Trust.

2016 Compliance Changes Summary of Earnings (SOE) The Inland Revenue will produce the SOE file early in XXXX 2016. IR10 KP21 has been renamed to ‘Assc’d persons remun’ (Associated persons remuneration). Report has also been changed to reflect the renaming of the Keypoint. IR215 There were no IRD Specification changes for the 2016 return year. At no point in the future does the IRD ever ask for details of Assets and Liabilities (indeed with Companies, Partnerships etc etc) in the Tax returns, except for dollar values in an IR10, and thats whether the Trust is a Foreign Trust, A Complying Trust, and Non Complying Trust or a Charitable Trust.

2016 Compliance Changes Summary of Earnings (SOE) The Inland Revenue will produce the SOE file early in XXXX 2016. IR10 KP21 has been renamed to ‘Assc’d persons remun’ (Associated persons remuneration). Report has also been changed to reflect the renaming of the Keypoint. IR215 There were no IRD Specification changes for the 2016 return year. At no point in the future does the IRD ever ask for details of Assets and Liabilities (indeed with Companies, Partnerships etc etc) in the Tax returns, except for dollar values in an IR10, and thats whether the Trust is a Foreign Trust, A Complying Trust, and Non Complying Trust or a Charitable Trust.

The European Organisation for the Exploitation of Meteorological Satellites (EUMETSAT) MetOp-A and MetOp-B satellites fly in the same polar orbit with a 180° phase difference, which enables the global retrieval of atmospheric motion vectors (AMVs, or ''winds'') by tracking clouds in a pair of Advanced Very High Resolution Radiometer (AVHRR Completing a Financial statements summary IR10 will help speed up the processing of your tax return. You do not have to include your financial records, although we may ask for them later. Our IR10 guide will help you complete this summary. Note: Use this form for returns for the 2016 tax year onwards.

On October 27, 2016, Atlassian Corporation Plc (the “Company”) issued a press release announcing its results for the fiscal quarter ended September 30, 2016. A copy of the press release is attached as Exhibit 99.1 to this report on Form 6-K and is incorporated by reference herein. 06.07.2016 · Any questions you have ask away and I will do my best to answer them. I am a Chartered Accountant but please do not consider any of this professional advice. I am working with exactly as much information as you give me and also "the guy on the internet who claimed to be an accountant said so" is not a good defense for anything really :D I

Guide to keeping people healthy and safe at work . Getting the best from people. Six tips for filing your tax return by 7 July. It’s tax time again. Income tax returns for the year ending 31 March 2016 are due by 7 July. If a tax agent or accountant files on your behalf, The European Organisation for the Exploitation of Meteorological Satellites (EUMETSAT) MetOp-A and MetOp-B satellites fly in the same polar orbit with a 180° phase difference, which enables the global retrieval of atmospheric motion vectors (AMVs, or ''winds'') by tracking clouds in a pair of Advanced Very High Resolution Radiometer (AVHRR

On October 27, 2016, Atlassian Corporation Plc (the “Company”) issued a press release announcing its results for the fiscal quarter ended September 30, 2016. A copy of the press release is attached as Exhibit 99.1 to this report on Form 6-K and is incorporated by reference herein. The European Organisation for the Exploitation of Meteorological Satellites (EUMETSAT) MetOp-A and MetOp-B satellites fly in the same polar orbit with a 180° phase difference, which enables the global retrieval of atmospheric motion vectors (AMVs, or ''winds'') by tracking clouds in a pair of Advanced Very High Resolution Radiometer (AVHRR

29.05.2016 · Ask your accounting and tax questions here; One IR10 for each company. one IR10 for my personal income, that is my IR3,personal tax return. But reading IRD tax guides, it means it has to be one IR10 for each business entity,even though if they are controlled by the same person. Visit MYOB's end of financial year 2019 resource page for updates and use our handy tax year planner.

Taxation is one tool - alongside regulation and spending measures - that can support and guide this transition. 19. The task for policymakers is to think in terms of systems change and to develop a set of goals and principles that can guide a transition, over many decades, to a more sustainable economy. 20. Selling your property, taxes and depreciation recovery IRD treats depreciation recovery as a form of taxable income. Example: On 1 April 2016, if you sold the property for $1 million, you have to include as income the depreciation recovery of $6000 in your income tax return.

This consultation closed on Monday 30 May 2016. Ministers will now consider your feedback and work out how to take the next steps on simplifying business tax. You can still look at comments that others have made on this site and our other consultations. We'll be looking for more of … The Profit and Loss statement offers you an important means of monitoring the progress of your business so it's important that you understand how it works. This guide offers a simple explanation of its structure and how you can use the Profit and Loss statement to better manage your business.

PENALTIES AND OFFENCES under the VAT Law

New Zealand Business Demography Statistics (Structural. ISSUE DATE: 09/2016. The U.S. Citizenship and Immigration Services (USCIS) class code may be stamped on an I-551, a passport, or any other correspondence USCIS gives an immigrant. The class codes listed below are those given to immigrants applying for Lawful Permanent Resident (LPR) status., Business demography statistics . Business demography statistics provide an annual snapshot (as at February) of the structure and characteristics of New Zealand businesses. The series covers economically significant individual, private-sector and public-sector enterprises that are engaged in the production of goods and services in New Zealand..

Classic.ird.govt.nz site-stats.org

Ask your accounting and tax questions here (Page 21. Findchips Pro offers complete visibility on the sourcing ecosystem and delivers actionable insights to supply chain, engineering and business teams. At a company level, adopting a single repository of up-to-date information allows for better communication., The Profit and Loss statement offers you an important means of monitoring the progress of your business so it's important that you understand how it works. This guide offers a simple explanation of its structure and how you can use the Profit and Loss statement to better manage your business..

This consultation closed on Monday 30 May 2016. Ministers will now consider your feedback and work out how to take the next steps on simplifying business tax. You can still look at comments that others have made on this site and our other consultations. We'll be looking for more of … Findchips Pro offers complete visibility on the sourcing ecosystem and delivers actionable insights to supply chain, engineering and business teams. At a company level, adopting a single repository of up-to-date information allows for better communication.

The Profit and Loss statement offers you an important means of monitoring the progress of your business so it's important that you understand how it works. This guide offers a simple explanation of its structure and how you can use the Profit and Loss statement to better manage your business. Findchips Pro offers complete visibility on the sourcing ecosystem and delivers actionable insights to supply chain, engineering and business teams. At a company level, adopting a single repository of up-to-date information allows for better communication.

Completing a Financial statements summary IR10 will help speed up the processing of your tax return. You do not have to include your financial records, although we may ask for them later. Our IR10 guide will help you complete this summary. Note: Use this form for returns for the 2016 tax year onwards. The European Organisation for the Exploitation of Meteorological Satellites (EUMETSAT) MetOp-A and MetOp-B satellites fly in the same polar orbit with a 180° phase difference, which enables the global retrieval of atmospheric motion vectors (AMVs, or ''winds'') by tracking clouds in a pair of Advanced Very High Resolution Radiometer (AVHRR

The Profit and Loss statement offers you an important means of monitoring the progress of your business so it's important that you understand how it works. This guide offers a simple explanation of its structure and how you can use the Profit and Loss statement to better manage your business. Taxation is one tool - alongside regulation and spending measures - that can support and guide this transition. 19. The task for policymakers is to think in terms of systems change and to develop a set of goals and principles that can guide a transition, over many decades, to a more sustainable economy. 20.

Guide to keeping people healthy and safe at work . Getting the best from people. Six tips for filing your tax return by 7 July. It’s tax time again. Income tax returns for the year ending 31 March 2016 are due by 7 July. If a tax agent or accountant files on your behalf, The Profit and Loss statement offers you an important means of monitoring the progress of your business so it's important that you understand how it works. This guide offers a simple explanation of its structure and how you can use the Profit and Loss statement to better manage your business.

Findchips Pro offers complete visibility on the sourcing ecosystem and delivers actionable insights to supply chain, engineering and business teams. At a company level, adopting a single repository of up-to-date information allows for better communication. On October 27, 2016, Atlassian Corporation Plc (the “Company”) issued a press release announcing its results for the fiscal quarter ended September 30, 2016. A copy of the press release is attached as Exhibit 99.1 to this report on Form 6-K and is incorporated by reference herein.

On October 27, 2016, Atlassian Corporation Plc (the “Company”) issued a press release announcing its results for the fiscal quarter ended September 30, 2016. A copy of the press release is attached as Exhibit 99.1 to this report on Form 6-K and is incorporated by reference herein. Guide to keeping people healthy and safe at work . Getting the best from people. Six tips for filing your tax return by 7 July. It’s tax time again. Income tax returns for the year ending 31 March 2016 are due by 7 July. If a tax agent or accountant files on your behalf,

Selling your property, taxes and depreciation recovery IRD treats depreciation recovery as a form of taxable income. Example: On 1 April 2016, if you sold the property for $1 million, you have to include as income the depreciation recovery of $6000 in your income tax return. Completing a Financial statements summary IR10 will help speed up the processing of your tax return. You do not have to include your financial records, although we may ask for them later. Our IR10 guide will help you complete this summary. Note: Use this form for returns for the 2016 tax year onwards.

now on wednesday, friday and sunday v venice * of l0el bes8tw, w, 205 va13li o ford asjille fl 3261.1 local news cover to cover florida's no. 1 weekly newspaper Aside from the obvious, deductions also include interest on money borrowed for the business, and interest charged by the IRD for underpayment of tax and any Fringe Benefit Tax you’ve paid. Business related legal fees from a NZ or Australian registered legal service of up to a maximum of $10,000 can be deducted in an income year.

07.04.2016 · However, for the companies, LTCs, etc, you do need to fill in an IR10, which is a much more detailed version of the IR3R, encompassing all business activities, and also needs a view of the Balance Sheet. The IRD website gives you an option for "Are you filing your IR10 online now with this return?" The European Organisation for the Exploitation of Meteorological Satellites (EUMETSAT) MetOp-A and MetOp-B satellites fly in the same polar orbit with a 180° phase difference, which enables the global retrieval of atmospheric motion vectors (AMVs, or ''winds'') by tracking clouds in a pair of Advanced Very High Resolution Radiometer (AVHRR

Bir online filing of income tax return – Goddess Of Gadgets. Aside from the obvious, deductions also include interest on money borrowed for the business, and interest charged by the IRD for underpayment of tax and any Fringe Benefit Tax you’ve paid. Business related legal fees from a NZ or Australian registered legal service of up to a maximum of $10,000 can be deducted in an income year., 11.05.2017 · Any questions you have ask away and I will do my best to answer them. I am a Chartered Accountant but please do not consider any of this professional advice. I am working with exactly as much information as you give me and also "the guy on the internet who claimed to be an accountant said so" is not a good defense for anything really :D I.

New Zealand Business Demography Statistics (Structural

(PDF) A Comparison of Qualitative and Quantitative Firm. Furthermore, a new section 33AA TAA 1994 is expected to take effect from 1 April 2016, which is the start of the 2016-17 income year for most individuals. As part of drafting the amendments to give effect to the proposed amalgamation of the two main income tax …, Furthermore, a new section 33AA TAA 1994 is expected to take effect from 1 April 2016, which is the start of the 2016-17 income year for most individuals. As part of drafting the amendments to give effect to the proposed amalgamation of the two main income tax ….

Classic.ird.govt.nz site-stats.org

Classic.ird.govt.nz site-stats.org. Visit MYOB's end of financial year 2019 resource page for updates and use our handy tax year planner. https://en.wikipedia.org/wiki/Jurong_Bird_Park Taxation is one tool - alongside regulation and spending measures - that can support and guide this transition. 19. The task for policymakers is to think in terms of systems change and to develop a set of goals and principles that can guide a transition, over many decades, to a more sustainable economy. 20..

29.05.2016 · Ask your accounting and tax questions here; One IR10 for each company. one IR10 for my personal income, that is my IR3,personal tax return. But reading IRD tax guides, it means it has to be one IR10 for each business entity,even though if they are controlled by the same person. Taxation is one tool - alongside regulation and spending measures - that can support and guide this transition. 19. The task for policymakers is to think in terms of systems change and to develop a set of goals and principles that can guide a transition, over many decades, to a more sustainable economy. 20.

Findchips Pro offers complete visibility on the sourcing ecosystem and delivers actionable insights to supply chain, engineering and business teams. At a company level, adopting a single repository of up-to-date information allows for better communication. 2016 Compliance Changes Summary of Earnings (SOE) The Inland Revenue will produce the SOE file early in XXXX 2016. IR10 KP21 has been renamed to ‘Assc’d persons remun’ (Associated persons remuneration). Report has also been changed to reflect the renaming of the Keypoint. IR215 There were no IRD Specification changes for the 2016 return year.

ISSUE DATE: 09/2016. The U.S. Citizenship and Immigration Services (USCIS) class code may be stamped on an I-551, a passport, or any other correspondence USCIS gives an immigrant. The class codes listed below are those given to immigrants applying for Lawful Permanent Resident (LPR) status. On October 27, 2016, Atlassian Corporation Plc (the “Company”) issued a press release announcing its results for the fiscal quarter ended September 30, 2016. A copy of the press release is attached as Exhibit 99.1 to this report on Form 6-K and is incorporated by reference herein.

Taxation is one tool - alongside regulation and spending measures - that can support and guide this transition. 19. The task for policymakers is to think in terms of systems change and to develop a set of goals and principles that can guide a transition, over many decades, to a more sustainable economy. 20. 29.05.2016 · Ask your accounting and tax questions here; One IR10 for each company. one IR10 for my personal income, that is my IR3,personal tax return. But reading IRD tax guides, it means it has to be one IR10 for each business entity,even though if they are controlled by the same person.

2016 Compliance Changes Summary of Earnings (SOE) The Inland Revenue will produce the SOE file early in XXXX 2016. IR10 KP21 has been renamed to ‘Assc’d persons remun’ (Associated persons remuneration). Report has also been changed to reflect the renaming of the Keypoint. IR215 There were no IRD Specification changes for the 2016 return year. ISSUE DATE: 09/2016. The U.S. Citizenship and Immigration Services (USCIS) class code may be stamped on an I-551, a passport, or any other correspondence USCIS gives an immigrant. The class codes listed below are those given to immigrants applying for Lawful Permanent Resident (LPR) status.

Selling your property, taxes and depreciation recovery IRD treats depreciation recovery as a form of taxable income. Example: On 1 April 2016, if you sold the property for $1 million, you have to include as income the depreciation recovery of $6000 in your income tax return. The Profit and Loss statement offers you an important means of monitoring the progress of your business so it's important that you understand how it works. This guide offers a simple explanation of its structure and how you can use the Profit and Loss statement to better manage your business.

At no point in the future does the IRD ever ask for details of Assets and Liabilities (indeed with Companies, Partnerships etc etc) in the Tax returns, except for dollar values in an IR10, and thats whether the Trust is a Foreign Trust, A Complying Trust, and Non Complying Trust or a Charitable Trust. Can IRD and TMNZ talk to each other to flag in the IRD system who are TMNZ clients so that the client doesn’t receive statements showing lots of tax & int owing In preparation for release 3, we are working with Tax Pooling intermediaries to move processing of …

Business demography statistics . Business demography statistics provide an annual snapshot (as at February) of the structure and characteristics of New Zealand businesses. The series covers economically significant individual, private-sector and public-sector enterprises that are engaged in the production of goods and services in New Zealand. The European Organisation for the Exploitation of Meteorological Satellites (EUMETSAT) MetOp-A and MetOp-B satellites fly in the same polar orbit with a 180° phase difference, which enables the global retrieval of atmospheric motion vectors (AMVs, or ''winds'') by tracking clouds in a pair of Advanced Very High Resolution Radiometer (AVHRR

Findchips Pro offers complete visibility on the sourcing ecosystem and delivers actionable insights to supply chain, engineering and business teams. At a company level, adopting a single repository of up-to-date information allows for better communication. Business demography statistics . Business demography statistics provide an annual snapshot (as at February) of the structure and characteristics of New Zealand businesses. The series covers economically significant individual, private-sector and public-sector enterprises that are engaged in the production of goods and services in New Zealand.

The European Organisation for the Exploitation of Meteorological Satellites (EUMETSAT) MetOp-A and MetOp-B satellites fly in the same polar orbit with a 180° phase difference, which enables the global retrieval of atmospheric motion vectors (AMVs, or ''winds'') by tracking clouds in a pair of Advanced Very High Resolution Radiometer (AVHRR PENALTIES AND OFFENCES under the VAT Law . Introduction. Many tax penalties are substantial and can dramatically increase a tax bill. Penalties can be assessed for a variety of reasons.

Aside from the obvious, deductions also include interest on money borrowed for the business, and interest charged by the IRD for underpayment of tax and any Fringe Benefit Tax you’ve paid. Business related legal fees from a NZ or Australian registered legal service of up to a maximum of $10,000 can be deducted in an income year. The Profit and Loss statement offers you an important means of monitoring the progress of your business so it's important that you understand how it works. This guide offers a simple explanation of its structure and how you can use the Profit and Loss statement to better manage your business.